A Health Savings Account (HSA) is a tax-advantaged savings account that individuals can use to set aside funds for qualified medical expenses. HSAs are designed to work together with high-deductible health plans (HDHPs), which are health insurance plans with higher deductibles and lower premiums than traditional health insurance.

Health Savings Accounts (HSAs) have become increasingly popular as a powerful financial tool that offers individuals a unique way to save for medical expenses while enjoying significant tax advantages. HSAs help individuals cover current medical costs and provide a valuable means of building a nest egg for future healthcare needs. In this article, we will explore the main tax advantages of HSAs and discuss strategies to maximize your benefits.

High-Deductible Health Plan (HDHP):

To be eligible for an HSA, an individual must sign up for an eligible High-Deductible Health Plan. HDHP has specific requirements for minimum deductible amounts and maximum out-of-pocket limits.

2024 High Deductible Health Plan limits are:

Minimum deductible:

- $1,600 for self-only coverage ($100 increase from 2023)

- $3,200 for family coverage ($200 increase from 2023)

Out-of-pocket maximum:

- $8,050 for self-only coverage ($550 increase from 2023)

- $16,100 for family coverage ($1,100 increase from 2023)

HSA Contribution Limits:

The IRS sets annual contribution limits for HSAs. There are separate limits for individuals and families. Contributions can be made by the account holder, their employer, or both, but the total contributions must not exceed the annual limit.

For 2024, individuals under a high deductible health plan (HDHP) have an HSA contribution limit of $4,150, a $300 increase from 2023. The HSA contribution limit for family coverage Is $8,300, a $550 increase from 2023

There is a $1,000 HSA Catch-Up Contribution for individuals who are 55 and older.

HSA contribution deadline

Participants generally have until the tax filing deadline to contribute to an HSA. For tax year 2023, you can make contributions until April 15, 2024.

Age Restrictions:

There are no age restrictions for contributing to an HSA. However, individuals must not be enrolled in Medicare to contribute to an HSA. Once an individual enrolls in Medicare, they can no longer contribute to the HSA but can continue to withdraw funds for qualified medical expenses.

Qualified Medical Expenses:

You can use HSA funds for qualified medical expenses, including doctor visits, prescription medications, dental care, vision care, and certain medical services. You can even use your HSA funds to pay for some Medicare expenses, including Medicare Part B, Part D, and Medicare Advantage plan premiums.

Non-qualified expenses may incur taxes and penalties if funds are withdrawn before age 65.

Rollovers and Portability:

HSAs are portable, and funds can be rolled over yearly. Individuals can keep their HSA even if they change jobs or health plans.

Tax Advantages of HSAs:

HSA has three unique tax advantages, which makes it an outstanding tool for successful retirement planning.

Tax-Deductible Contributions:

One of the critical benefits of Health Savings Accounts is that they allow for tax-deductible contributions. Contributions to an HSA are typically tax-deductible. The money going into your HSA provides immediate tax benefits and reduces your annual taxable income.

Tax-Free Investment Growth:

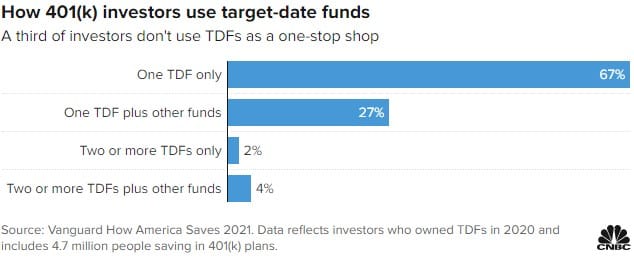

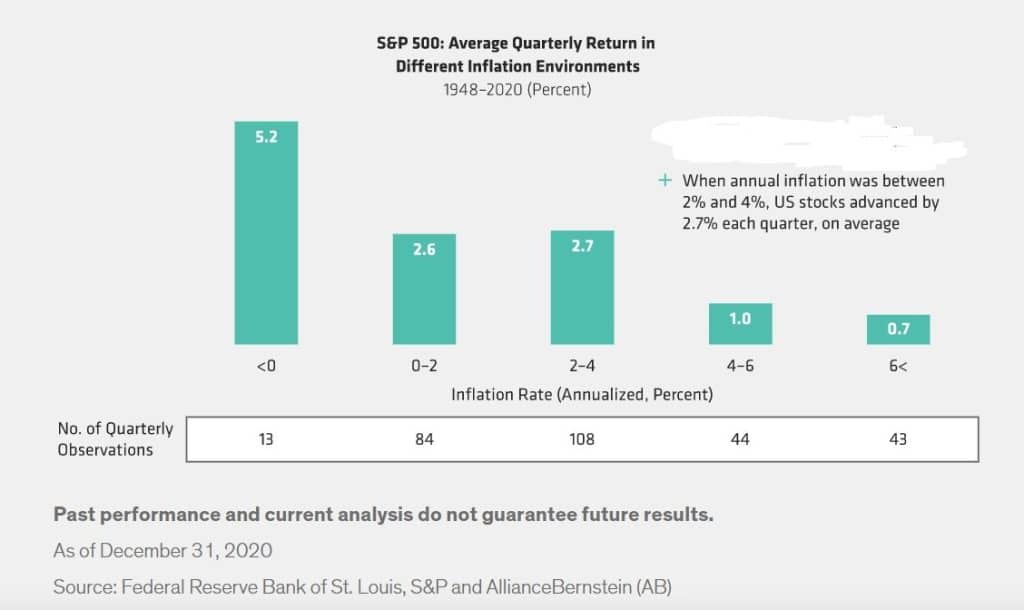

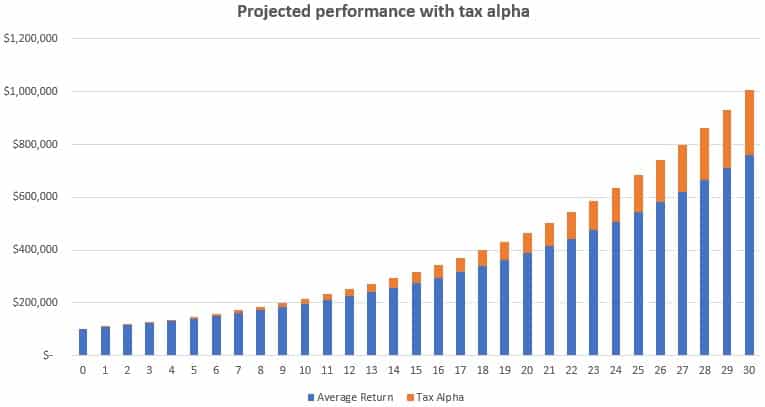

Another compelling tax advantage of HSAs is the opportunity for tax-free investment growth. Unlike FSA, HSAs allow individuals to invest their contributions in various investment options, such as stocks, bonds, and target date funds. The returns on these investments grow tax-free, providing an additional avenue for building wealth over time. Investing your HSA can be particularly advantageous for individuals who can afford to leave their HSA funds invested for the long term.

Tax-Free Withdrawals for Qualified Medical Expenses:

The most significant tax advantage of HSAs is the ability to make tax-free withdrawals for qualified medical expenses. The withdrawals are not subject to federal income tax as long as the funds are used for eligible healthcare expenses, including medical, dental, and vision care. This feature makes HSAs a powerful tool for managing healthcare costs, especially in the face of rising medical expenses.

Strategies to Maximize HSA Benefits:

Maximizing the benefits of a Health Savings Account (HSA) involves strategic planning and understanding how to leverage its unique features. Here are some strategies to help individuals make the most of their HSA

Contribute the Maximum Amount:

To fully capitalize on the tax advantages of HSAs, individuals should aim to contribute the maximum allowable amount each year. By doing so, they can maximize the immediate tax benefits of deductible contributions while building a substantial fund for future healthcare needs.

Invest HSA for Long-Term Growth:

While HSAs offer a cash component, taking advantage of the investment options within the account can significantly boost long-term growth. Consider a diversified investment strategy based on your risk tolerance and time horizon. This strategy can potentially generate higher returns than keeping your savings in cash.

Save your receipts.

The IRS requires you to keep receipts for all your HSA-eligible medical expenses. Whether you pay out of pocket or use an HSA debit card, you must retain all receipts for all eligible costs, which will be reported to the IRS.

No Time Limit for Reimbursing

There is no time limit for reimbursing yourself for eligible expenses. Participants can reimburse themself in 2024 for bills incurred in 2015 as long as they have the original receipt. It doesn’t matter how much time has passed; you can still submit your receipts. Moreover, you can do this even if you no longer participate in an eligible plan.

HSA and Healthcare FSA

You may wonder whether you should use a Health Savings Account or a Flexible Spending Account (FSA) to save on healthcare expenses. The FSA also allows pre-tax contributions to pay for medical costs, but any unused funds at the end of the year are forfeited. Some employer FSA plans may allow for a year-over-year carryover. The maximum 2024 carryover amount to 2025 is $640.

On the other hand, HSA funds roll over year to year and grow tax-free. Unlike an FSA, you own and keep the HSA account even if you change jobs. While an FSA may be more suitable for predictable recurring expenses like prescriptions, an HSA can be better for building long-term savings and enjoying tax-free growth on balances.

You can use both accounts, especially if you need to prepare for major medical expenses. You can pair HSA with a limited-purpose FSA to cover more predictable expenses such as co-pays, regular medications, dental, and vision costs.

Use HSA as a Retirement Savings Tool:

Taking advantage of your HSA tax benefits can be a part of your comprehensive financial and retirement plan. One smart strategy is to use your Health Savings Account as a supplemental retirement savings tool. If you don’t need to withdraw the funds now, you can invest your HSA balance and let it grow tax-free.

After age 65, HSA withdrawals can be used for any purpose without penalty, just like a traditional IRA. This approach allows your HSA to potentially become an additional retirement nest egg. Used this way, an HSA essentially becomes an IRA with the added benefit of allowing tax-free withdrawals if those funds are ever needed for medical expenses before retirement. Making the most of the tax advantages by maximizing contributions and investing balances allows your HSA to become a versatile long-term savings vehicle.

Conclusion:

Health Savings Accounts offer a trifecta of tax advantages that can significantly benefit individuals seeking a smart and tax-efficient way to manage their healthcare expenses. By maximizing contributions, investing for long-term growth, and considering the HSA as part of a comprehensive retirement strategy, you can unlock the full potential of HSAs, secure your financial well-being, and reach your goals.

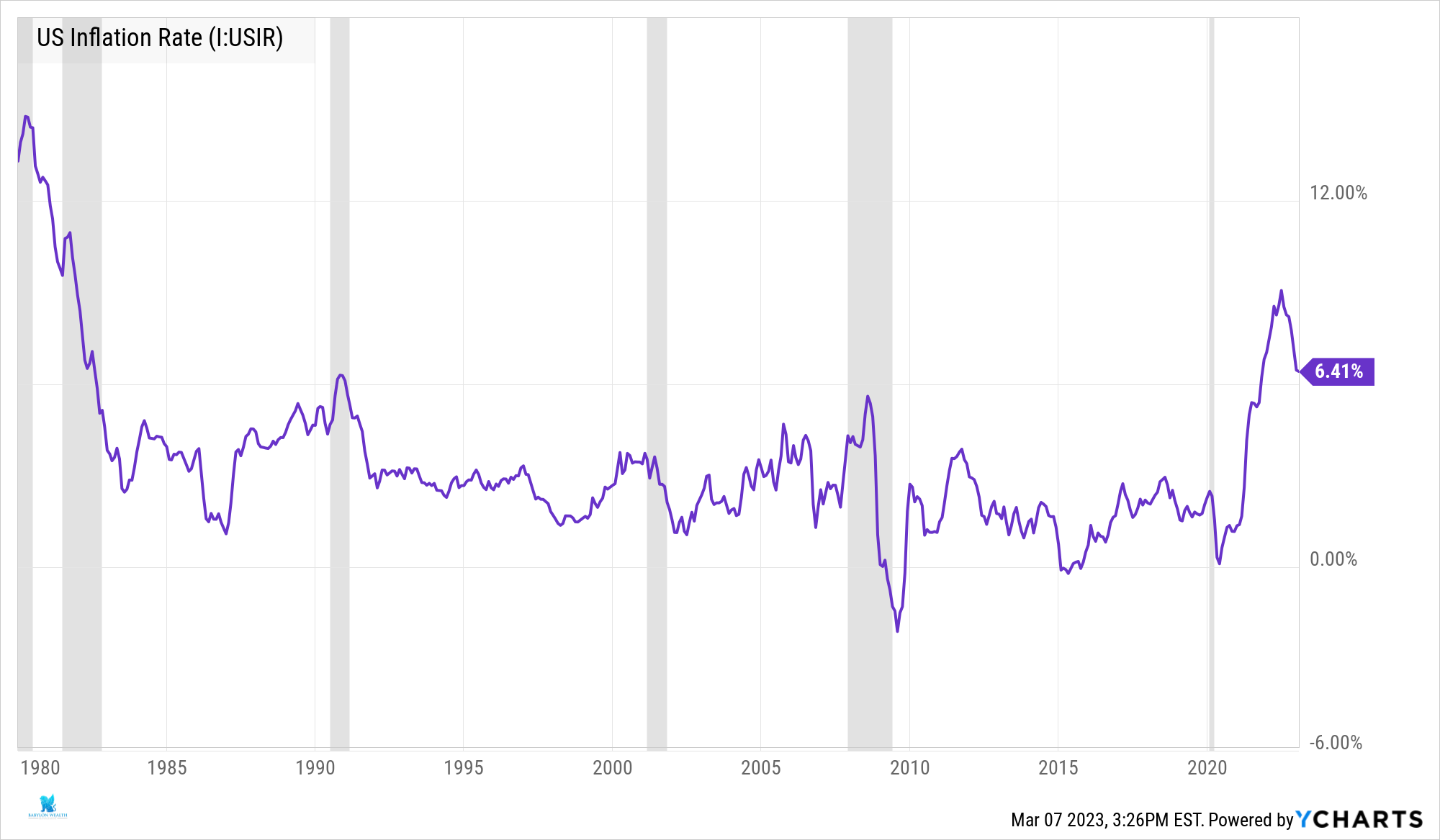

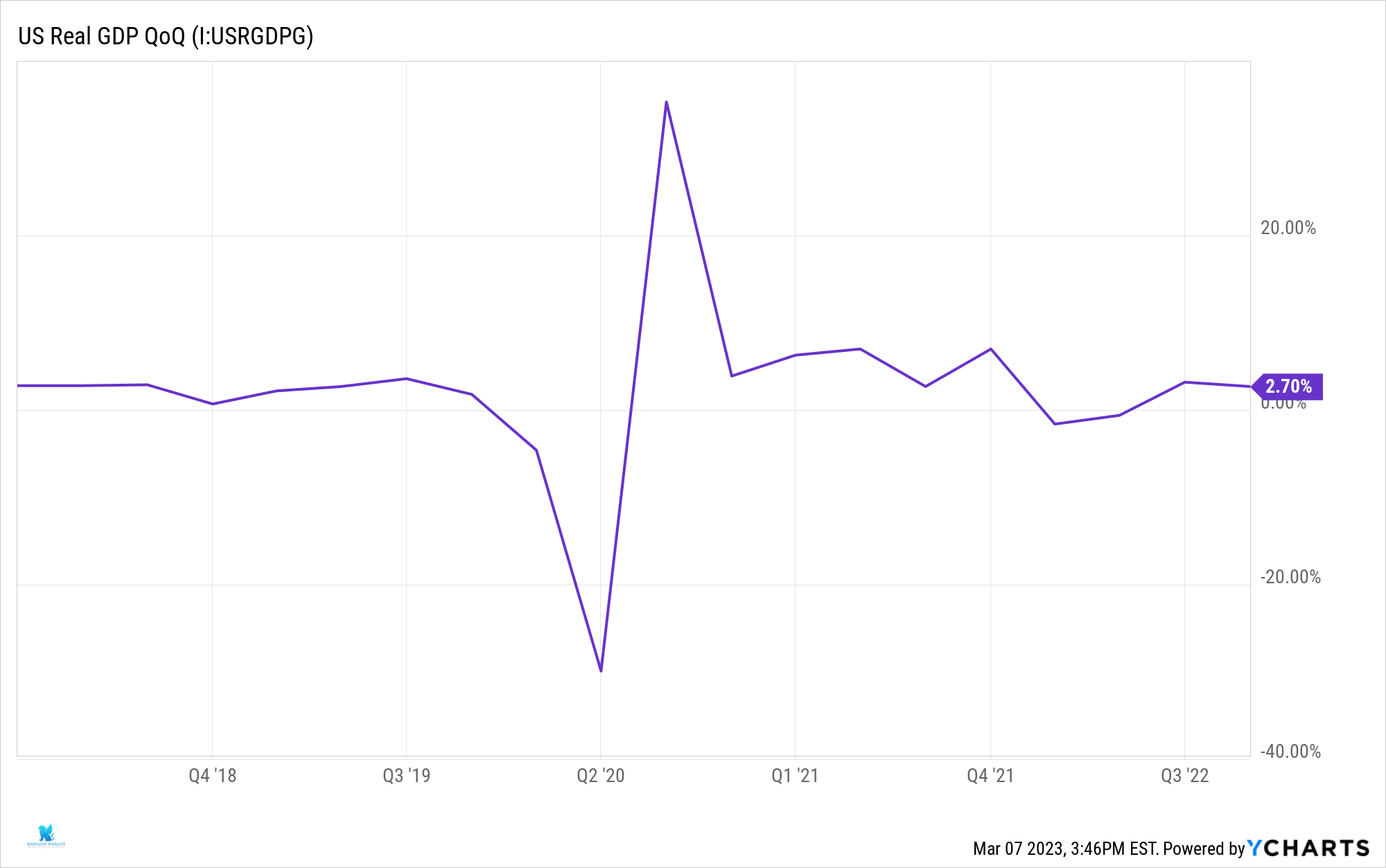

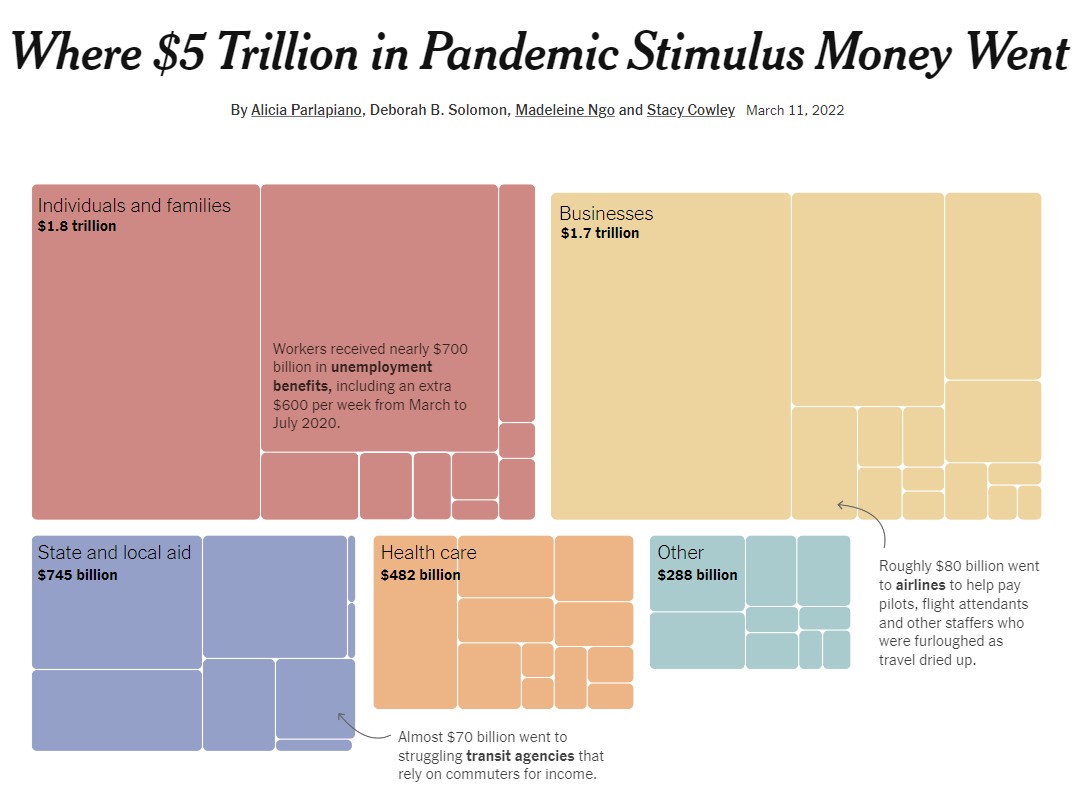

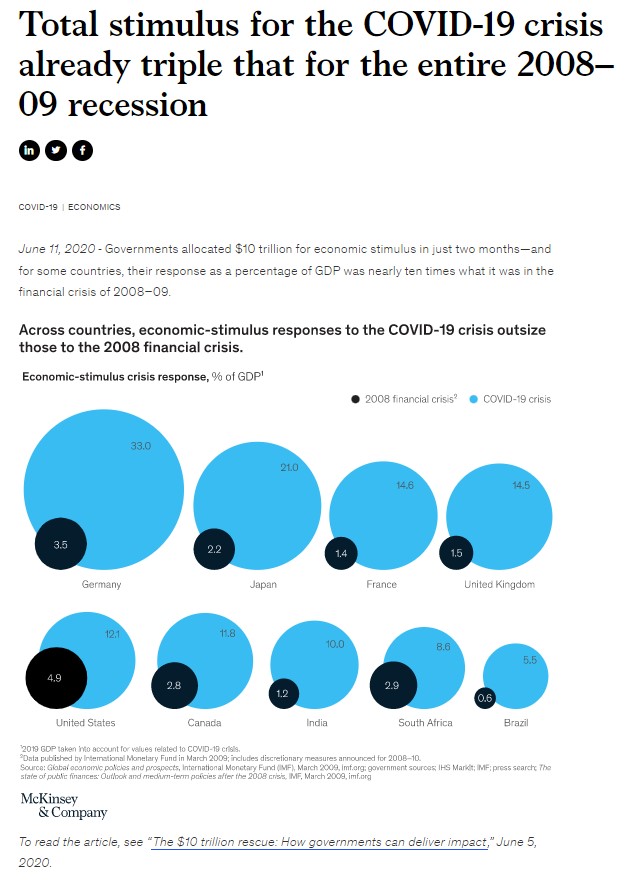

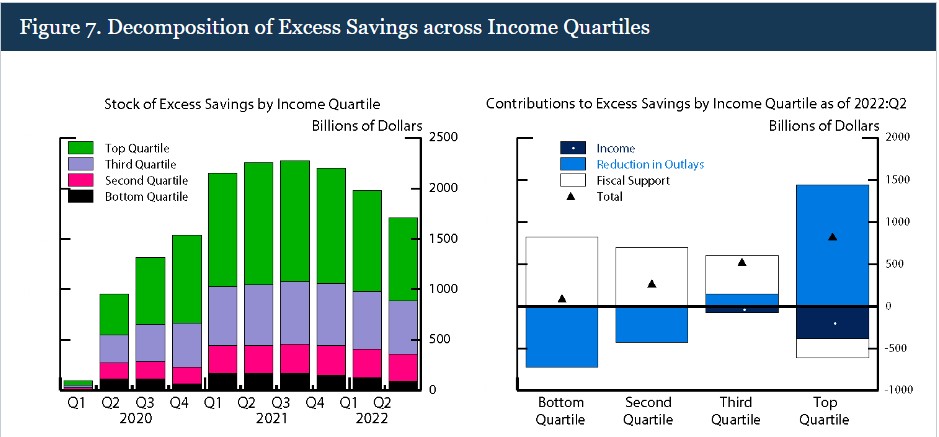

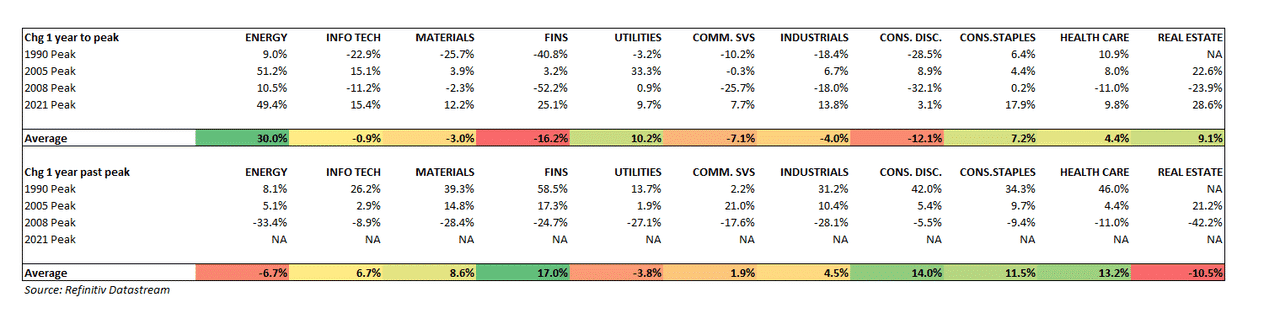

The bottom line is that we are in unchartered territory. The economy has way too much stimulus, and its lagging effect may persist for several years.

The bottom line is that we are in unchartered territory. The economy has way too much stimulus, and its lagging effect may persist for several years.

Robo-advisors have grown in popularity in the last 10 years, offering easy and inexpensive access to professional investment management with human interaction. Firms like Vanguard, Betterment, Personal Capital, and Wealth Front use online tools and algorithms to build and manage your investment. These digital advisors attract new customers with cutting-edge technology, attractive websites, interactive features, low fees, and cool mobile apps. The rising adoption of robo-advisors and various digital platforms allows the financial industry to become more accessible and consumer-friendly.

Robo-advisors have grown in popularity in the last 10 years, offering easy and inexpensive access to professional investment management with human interaction. Firms like Vanguard, Betterment, Personal Capital, and Wealth Front use online tools and algorithms to build and manage your investment. These digital advisors attract new customers with cutting-edge technology, attractive websites, interactive features, low fees, and cool mobile apps. The rising adoption of robo-advisors and various digital platforms allows the financial industry to become more accessible and consumer-friendly.