The recent market volatility – the tale of the perfect storm

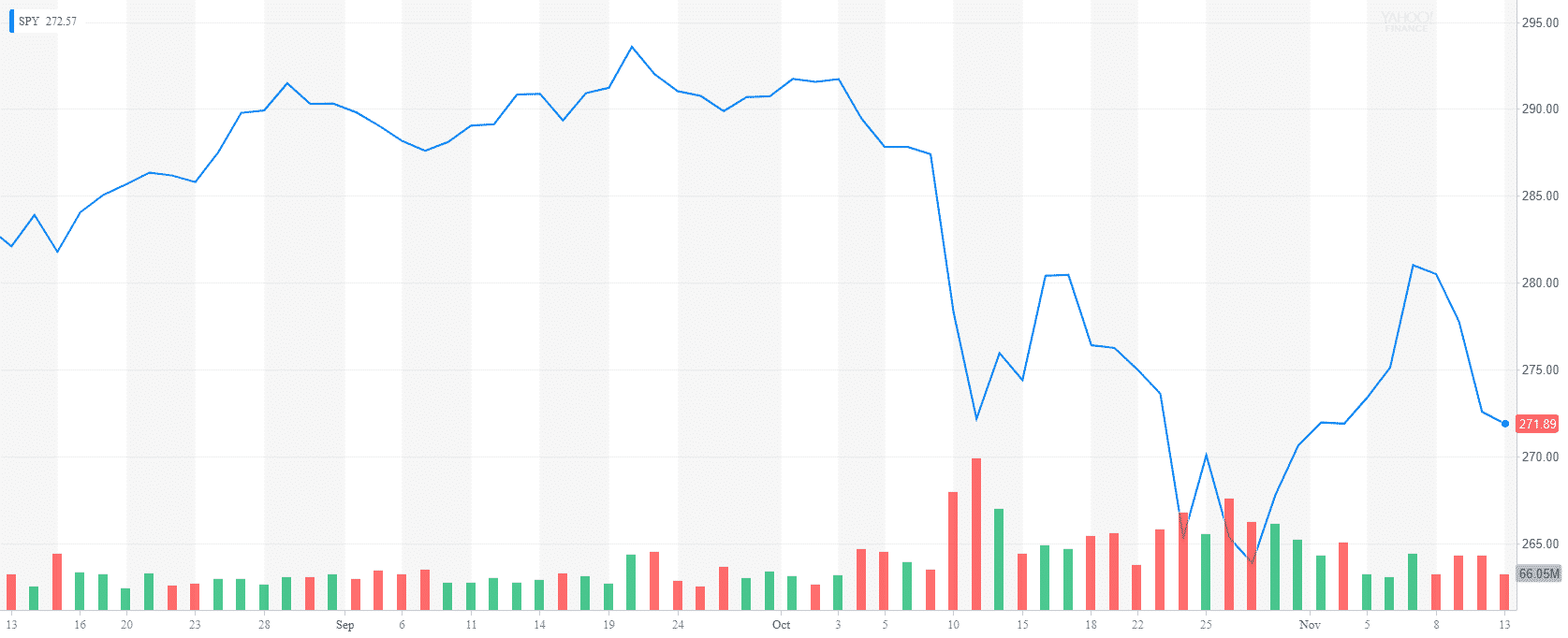

October is traditionally a rough month for stocks. And October 2018 proved it.

S&P 500 went down -6.9% in October after gaining as much as 10.37% in the first nine months of the year. Despite recouping some of its losses in early November, the market continues to be volatile, with large daily swings in both directions. On top of that, Small Cap stocks, which were leading the way till late September, went down almost 10% in the span of a few weeks.

So, what led to this rout?

The market outlook in September was very positive. Consumer sentiment and business optimism were at a record high. Unemployment hit a record low. And the market didn’t really worry about tariffs.

I compiled a list of factors that had a meaningful impact on the recent market volatility. As the headline suggested, I don’t believe there was a single catalyst that drove the market down but a sequence of events creating a perfect storm for the equities to go down.

| Index |

Q1 2018 |

Q2 2018 |

Q3 2018 |

Q3 YTD 2018 |

Oct – Nov 2018 |

Nov 2018 YTD |

| S&P 500 Large-Cap (SPY) |

-1.00% |

3.55% |

7.65% |

10.37% |

-4.91% |

5.45% |

| S&P 600 Small-Cap (IJR) |

0.57% |

8.69% |

4.87% |

14.64% |

-9.54% |

5.09% |

| MSCI EAFE (VEA) |

-0.90% |

-1.96% |

1.23% |

-1.62% |

-7.06% |

-8.68% |

| Barclays US Aggregate Bond (AGG) |

-1.47% |

-0.18% |

-0.08% |

-1.73% |

-0.81% |

-2.54% |

| Gold (GLD) |

1.73% |

-5.68% |

-4.96% |

-8.81% |

1.39% |

-7.42% |

Source: Morningstar

|

|

|

|

|

|

|

1. Share buybacks

The month of October is earnings season. Companies are not allowed to buy back shares as they announce their earnings. The rationale is that they possess significant insider information that could influence the market in each direction. As it turned out, 2018 was a big year for share buybacks. Earlier in the year, S&P estimated $1 trillion worth of share buybacks to be returned to shareholders. So, in October, the market lost a big buyer – the companies who were buying their own shares. And no one stepped in to take their place.

The explosion of share buyback was prompted by the TCJA law last year which lowered the tax rate of US companies from 35% to 21%. Additionally, the new law imposed a one-time tax on pre-2018 profits of foreign affiliates at rates of 15.5% for cash and 8% for non-cash assets. Within a few months, many US mega-cap corporations brought billions of cash from overseas and became buyers of their stock.

2. High valuations

With the bull market is going on its ninth year, equity valuations remain high even after the October market selloff.

Currently, the S&P 500 is trading at 22.2, above the average level of 15.7. Its dividend yield is 1.9%, well below the historical average of 4.34%.

Furthermore, the current Shiller PE Ratio stands at 30.73, one of the highest levels in history. While the traditional Price to Earnings ratio is calculated based on current or estimated earning levels, the Schiller ratio calculates average inflation-adjusted earnings from the previous ten years. The ratio is also known as the Cyclically Adjusted PE Ratio (CAPE Ratio) or PE10.

While a coordinated global growth and low-interest rate environment had previously supported the thesis that high valuation ratios were justified, this may not be the case for much longer.

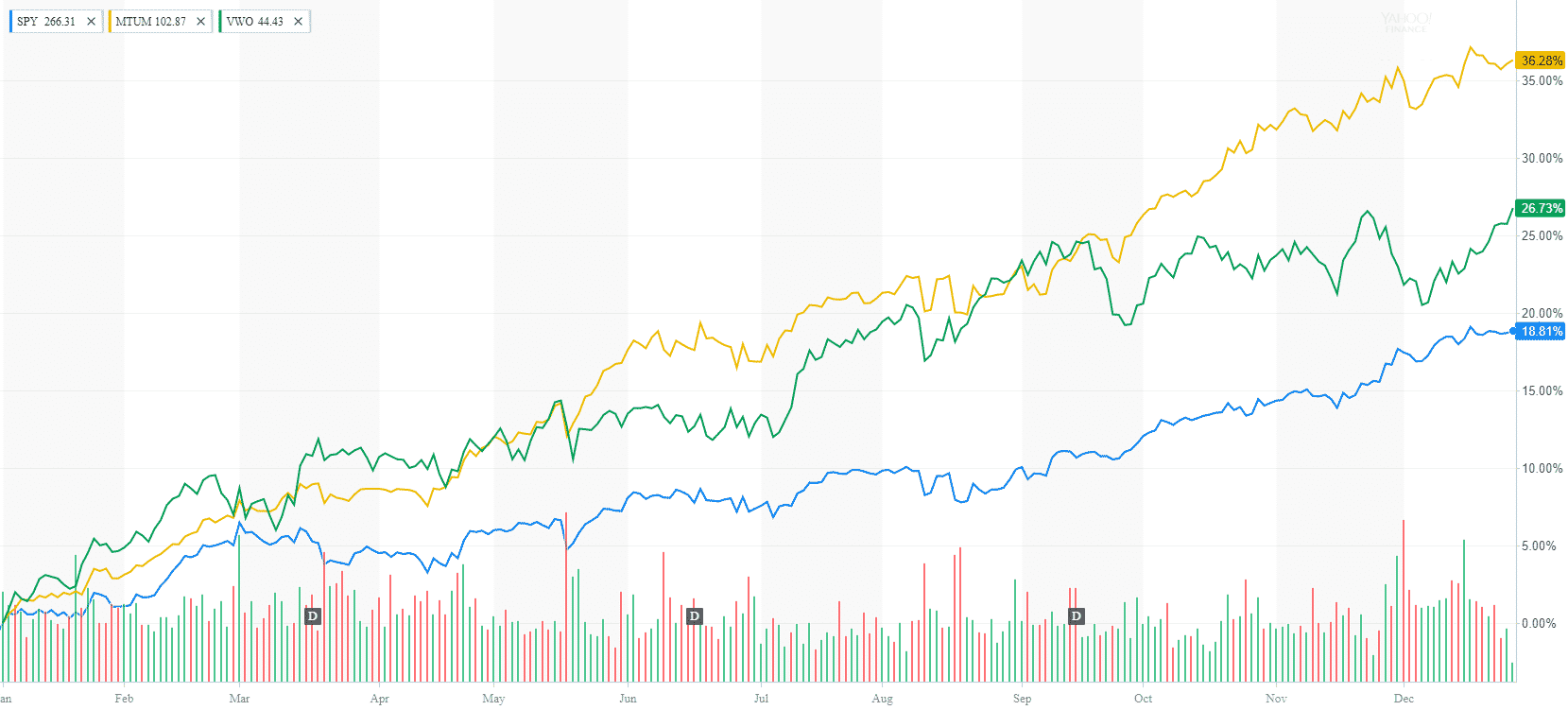

3. The divergence between US and international stocks

The performance of International Developed and Emerging Market remains disappointing. While the US markets are still in positive territory, International Developed and EM stocks have plunged by -8% and -15% respectively so far in 2018. Higher tariffs imposed by the US, negative Brexit news, growing domestic debt in China, and slower GDP growth in both the Eurozone and China have spurred fears of an upcoming recession. Despite attractive valuations, international markets remain in correction territory, The dividend yield of MSCI EAFE is 3.34%, while MSCI EM is paying 2.5%, both higher than 1.9% for S&P 500.

4. The gap between growth and value stocks

The performance gap between growth and value stocks is still huge. Growths stocks like Apple, Amazon, Google, Visa, MasterCard, UnitedHealth, Boeing, Nvidia, Adobe, Salesforce, and Netflix have delivered 10% return so far this year. At the same time value strategies dominated by Financials, Consumer Staples and Energy companies are barely breaking even.

| Index |

Q1 2018 |

Q2 2018 |

Q3 2018 |

Q3 YTD 2018 |

Oct – Nov 2018 |

Nov 2018 YTD |

P/E Ratio |

| S&P 500 Large Cap Growth (IVW) |

1.81% |

5.17% |

9.25% |

16.97% |

-6.95% |

10.01% |

29.90 |

| S&P 500 Large Cap Value (IVE) |

-3.53% |

1.38% |

5.80% |

3.26% |

-2.59% |

0.67% |

19.44 |

5. Tempering earnings growth

So far in Q3 2018, 90% of the companies have announced earnings. 78% of them have reported better than expected actual earnings with an average earnings growth rate of 25.2%. 61% of the companies have reported a positive sales surprise. However, 58 companies in the S&P 500 (12%) have issued negative earnings guidance for Q4 2018. And the list of stocks that tumbled due to cautious outlook keeps growing – JP Morgan, Facebook, Home Depot, Sysco, DR Horton, United Rentals, Texas Instruments, Carvana, Zillow, Shake Shack, Skyworks Solutions, Michael Kors, Oracle, GE, Cerner, Activision, etc.

Despite the high consumer optimism and growing earnings, most companies’ CFOs are taking a defensive approach. Business investment grew at a 0.8% annual rate in the third quarter, down from 8.7% in the second quarter. This was the slowest pace since the fourth quarter of 2016.

The investment bank Nomura also came out with the forecast expecting global growth to slow down. Their economists predicted that global growth in 2019 would hit 3.7% and temper to 3.5% in 2020 from 3.9% in 2018. According to Nomura, the drivers for the slowdown include waning fiscal stimulus in the U.S., tighter monetary policy from the Federal Reserve, increased supply constraints and elevated risk of a partial government shutdown.

6. Inflation is creeping up

Almost a decade since the Credit Crisis in 2008-2009, inflation has been hovering below 2%. However, in 2018, the inflation has finally made a comeback. In September 2018, monthly inflation was 2.3% down from 2.9% in July and 2.7% in August.

One winner of the higher prices is the consumer staples like Procter & Gamble, Unilever, and Kimberly-Clark. Most of these companies took advantage of higher consumer confidence and rising wages to pass the cost of higher commodity prices to their customers.

7. Higher interests are starting to bite

After years of near-zero levels, interest rates are starting to go higher. 10-year treasury rate reached 3.2%, while the 2-year rate is slowly approaching the 3% level. While savers are finally beginning to receive a decent interest on their cash, CDs and saving accounts, higher interest rates will hurt other areas of the economy.

With household debt approaching $13.4 trillion, borrowers will pay higher interest for home, auto and student loans and credit card debt. At the same time, US government debt is approaching $1.4 trillion. Soon, the US government will pay more for interest than it is spending on the military. The total annual interest payment will hit $390 billion next year, nearly 50 percent more than in 2017, according to the Congressional Budget Office.

The higher interest rates are hurting the Financial sectors. Most big banks have enjoyed a long period of paying almost nothing on their client deposits and savings accounts. The rising interest rates though have increased the competition from smaller banks and online competitors offering attractive rates to their customers.

We are also monitoring the spread between 2 and 10-year treasury note, which is coming very close together. The scenario when two-year interest rates go above ten-year rates causes an inverted yield curve, which has often signaled an upcoming recession.

8. The housing market is slowing down

Both existing and new home sales have come down this year. Rising interest rates, higher cost of materials, labor shortage and high real estate prices in major urban areas have led to a housing market slow down. Existing home sales dropped 3.4% in September coming down for six months in a row this year. New building permits are down 5.5% over 2017.

Markets have taken a negative view on the housing market. As a result, most homebuilders are trading at a 52-week low.

9. Fear of trade war

Some 33% of the public companies have mentioned tariffs in their earnings announcements in Q3. 9% of them have negatively mentioned tariffs. According to the chart below, Industrials, Information Technology, Consumer Dictionary, and Materials are the leading sectors showing some level of concern about tariffs.

10. Strong dollar

Fed’s hiking of interest rates in the US has not been matched by its counterparts in the Eurozone, the UK, and Japan. The German 10-year bund now yields 0.4%, while Japanese 10-year government bond pays 0.11%. Combining the higher rates with negative Brexit talks, Italian budget crisis and trade war fears have led to a strong US dollar reaching a 17-month high versus other major currencies.

Given that 40% of S&P 500 companies’ revenue comes from foreign countries, the strong dollar is making Americans goods and services more expensive and less competitive abroad. Furthermore, US companies generating earnings in foreign currency will report lower US-dollar denominated numbers.

11. Consumer debt is at a record high

The US consumer debt is reaching 4 trillion dollars. Consumer debt includes non-mortgage debts such as credit cards, personal loans, auto loans, and student loans. Student loans are equal to $1.5 trillion while auto debt is $1.1 trillion and credit card debt is close to $1.05 trillion. Furthermore, the US housing dent also hit a record high. In June, the combined mortgage and home equity debt were equal to $9.43 trillion, according to the NY Fed.

The rising debt has been supported by low delinquencies, high property values, rising wages, and low unemployment. However, a slowdown in the economy and the increasing inflation and interest rates can hurt US consumer spending.

12. High Yield and BBB-rated debt is growing

The size of the US corporate debt market has reached $7.5 trillion. The size of the BBB rated debt now exceeds 50% of the entire investment grade market. The BBB-rated debt is just one notch above junk status. Bloomberg explains that, in 2000, when BBB bonds were a mere third of the market, net leverage (total debt minus cash and short-term investments divided by earnings before interest, taxes, depreciation, and amortization) was 1.7 times. By the end of last year, the ratio had ballooned to 2.9 times.

Further on, the bond powerhouse PIMCO commented: “This suggests a greater tolerance from the credit rating agencies for higher leverage, which in turn warrants extra caution when investing in lower-rated IG names, especially in sectors where earnings are more closely tied to the business cycle.”

13. Oil remains volatile

After reaching $74.15 per barrel in October, US crude oil tumbled to $55, a 24% drop. While lower crude prices are pushing down on inflation, they are hurting energy companies, which are already trading in value territory.

According to WSJ, the oil’s rapid decline is fueling fears for global oversupply and slowing economic growth. Furthermore, the outlook for supply and demand shifted last month as top oil producers, began ramping up output to offset the expected drop in Iranian exports. However, earlier this month Washington decided to soften its sanctions on Iran and grant waivers to some buyers of Iranian crude—driving oil prices down. Another factor pushing down on oil was the strong dollar.

14. Global political uncertainty

The Brexit negotiations, Italian budget crisis, Trump’s threats to pull out of WTO, the EU immigrant crisis, higher tariffs, new elections in Brazil, Malaysian corruption scandal and alleged Saudi Arabia killing of a journalist have kept the global markets on their toes. Foreign markets have underperformed the US since the beginning of the year with no sign of hope coming soon.

15. The US Election results

A lot has been said about the US elections results, so I will not dig in further. In the next two year, we will have a divided Congress. The Democrats will control the house, while the Republicans will control the Senate and the executive branch. The initial market reaction was positive. Most investors are predicting a gridlock with no major legislature until 2020. Furthermore, we could have intense budget negotiations and even another government shutdown. Few potential areas where parties could try to work together are infrastructure and healthcare. However, any bi-partisan efforts might be clouded by the upcoming presidential elections and Mueller investigation results.

In Conclusion

There is never a right time to get in the market, start investing and saving for retirement. While market volatility will continue to prevail the news, there is also an opportunity for diligent investors to capitalize on their long-term view and patience. For these investors, it is essential to diversify and rebalance your portfolio.

In the near term, consumer confidence in the economy remains strong. Rising wages and low unemployment will drive consumer spending. My prediction is that we will see a record high shopping season. Many of these fifteen headwinds will remain. Some will soften while others will stay in the headlines.

If you have any questions about your existing investment portfolio or how to start investing for retirement and other financial goals, reach out to me at [email protected] or +925-448-9880.

You can also visit our Insights page where you can find helpful articles and resources on how to make better financial and investment decisions.

About the author:

Stoyan Panayotov, CFA is the founder and CEO of Babylon Wealth Management, a fee-only investment advisory firm based in Walnut Creek, CA. Babylon Wealth Management offers personalized wealth management and financial planning services to individuals and families. To learn more visit our Private Client Services page here. Additionally, we offer Outsourced Chief Investment Officer services to professional advisors (RIAs), family offices, endowments, defined benefit plans, and other institutional clients. To find out more visit our OCIO page here.

Disclaimer: Past performance does not guarantee future performance. Nothing in this article should be construed as a solicitation or offer, or recommendation, to buy or sell any security. The content of this article is a sole opinion of the author and Babylon Wealth Management. The opinion and information provided are only valid at the time of publishing this article. Investing in these asset classes may not be appropriate for your investment portfolio. If you decide to invest in any of the instruments discussed in the posting, you have to consider your risk tolerance, investment objectives, asset allocation, and overall financial situation. Different investors have different financial circumstances, and not all recommendations apply to everybody. Seek advice from your investment advisor before proceeding with any investment decisions. Various sources may provide different figures due to variations in methodology and timing,