Here is how to navigate the market turmoil after the Coronavirus outbreak, the stock market crash, and bottom low bond yields.

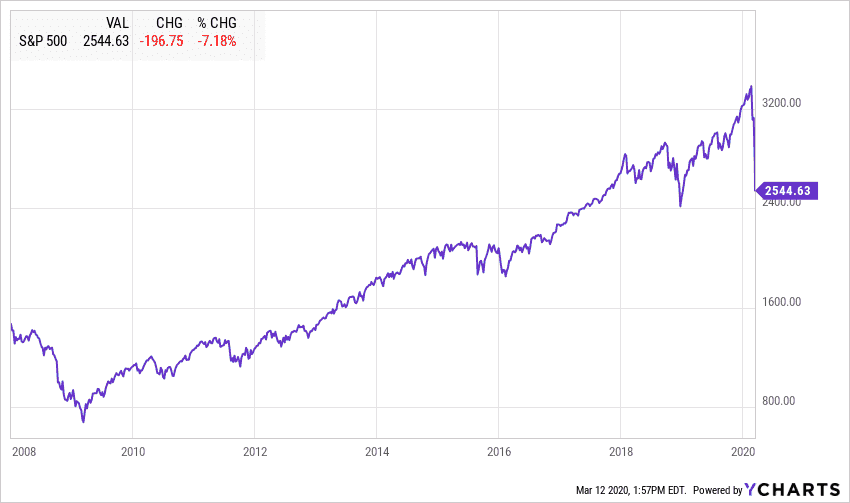

The longest bull market in history is officially over. Today the Dow Jones recorded its biggest daily loss since the October crash in 1987. Today will remain in the history books. After the Dow Jones index dropped more than 20% from its February 2020 high, we are formally in a bear market.

Investors’ flight to safety has pushed 10-year Treasury rate to 0.8% and 30-year treasury to 1.4%, all-time lows.

Where are we standing

The coronavirus outbreak is spreading globally. The virus fears are halting public events and forcing companies to change the way they conduct business. The US has imposed travel restrictions on China and the European Union. Many countries in the US are imposing border control restrictions on their neighbors. While the virus outbreak in Wuhan is officially contained according to the Chinese government, large parts of the country remain in lockdown.

The inability of governments around the world to contain COVID-19 spooked investors. We are now observing the worst stock market selloff since the financial crisis of 2008. In certain ways, the daily market conditions are more brutal and unpredictable than a decade ago. Currently, close to 80% of the stock trading is generated by computer algorithms who can send thousands of trades in milliseconds.

| Date | Dow Jones Index | Change | % Change |

| 12-Mar-20 | 21,200.95 | -2,352.27 | -9.99% |

| 11-Mar-20 | 23,553.22 | -1,464.94 | -5.86% |

| 10-Mar-20 | 25,018.16 | 1,167.14 | 4.89% |

| 9-Mar-20 | 23,851.02 | -2,013.76 | -7.79% |

| 6-Mar-20 | 25,864.78 | -256.50 | -0.98% |

| 5-Mar-20 | 26,121.28 | -969.58 | -3.58% |

| 4-Mar-20 | 27,090.86 | 1,173.45 | 4.53% |

| 3-Mar-20 | 25,917.41 | -785.91 | -2.94% |

| 2-Mar-20 | 26,703.32 | 1,293.96 | 5.09% |

| 28-Feb-20 | 25,409.36 | -357.28 | -1.39% |

| 27-Feb-20 | 25,766.64 | -1,190.95 | -4.42% |

| 26-Feb-20 | 26,957.59 | -123.77 | -0.46% |

| 25-Feb-20 | 27,081.36 | -879.44 | -3.15% |

| 24-Feb-20 | 27,960.80 | -1,031.61 | -3.56% |

The virus fears initially caused by a meltdown in travel-related stocks. Many airline and cruise ship stocks are now trading at a multi-year low. The heightened concerns for the global recession and the lowered commodity demand from China pushed the price of the oil down significantly. After failed negotiations between OPEC and Russia, Saudi Arabia decided to lower the sale prices of oil by 20% and increase its daily output. In turn, the prices of US oil companies collapsed due to fears that US oil producers can not maintain profitable operations at these low levels. During the previous in 2016, many small oil producers shut down or filed for bankruptcy. The expectation is that many more will follow the same faith soon.

Since the oil and gas and travel-related industry make up for more than 10% of the US GDP, it’s easy to understand that lower revenues and potential job cuts can trickle down to the rest of the US economy.

Are we in a recession?

We wouldn’t know the exact figures until April. The likelihood that the US economy will be in recession in Q1 and Q2 of 2020 is very high. The best-case scenario is for a sluggish economy. We started the year on a strong footing with low employment and strong job growth and housing sales, low price of oil and low-interest rates. However, the crisis in US travel, entertainment, and the energy sector can push the economy down.

What can you do now?

Focus on what you can control.

Have a plan

Having a robust financial plan will help you ensure that you are following of your long-term financial goals and staying on track. The investment performance of your portfolio is a key component of your future financial success but it’s not the most important factor. Be disciplined, patient and consistent in following your long-term goals while putting emotions aside

If you don’t have a financial plan, this a perfect time to initiate it. A holistic financial will help you create a comprehensive view of your personal and financial life and have a clear understanding of core risks and abilities to achieve financial independence and confidence.

Do not read the headlines

Wall Street resides in its own bubble and often overreacts to news whether that is good or bad. Right now, all news is bad news. The only thing that will provide confidence in the market is finding a treatment against the COVID-19, which is probably months or weeks away or drop in virus cases in both the US and Europe. A coordinated effort between the Fed, the Congress and the current administration can provide some stability. Let’s hope that all interested parties can come together and create a working plan.

Assess your risk tolerance

Risk tolerance is how we measure our emotional ability to accept market volatility. It’s not always easy to quantify emotions with numbers. As humans, we are always more likely to be risk-averse during market turbulence and more risk-tolerant when the stock market is going higher. If you want to know how you would feel when the stock market drops 20%, open your investment account today. When you are willing to accept short losses, then your risk tolerance is high. If losses are unacceptable then your risk tolerance is very low.

Review your investment portfolio

Perhaps not today, but soon, you should review your investment portfolio in connection with your long-term financial plan and risk tolerance. Make sure that your investments are aligned with your financial goals and needs.

Do not drop your 401k

One of the biggest mistakes you could possibly make now is to drop and stop contributing to your 401k plan. Many people gave up on their retirement savings during the financial crisis and never restarted them. As a result, we have a generation of people with no retirement savings. As a 401k participant, you make regular monthly or semi-monthly payments to your plan. Despite current losses, you benefit from dollar-cost averaging and buying stocks at lower prices.

Invest now

It may sound crazy but if you are a new investor there is no better time to start investing than now. Stocks rarely go on sale. This is one of those opportunities that come only once in a decade. Remember Warren Buffet’s famous quote:

“Be fearful when others are greedy and to be greedy only when others are fearful”

Check my blog for guidance and ideas

- In late January I posted “How to Survive the Next Market Downturn”. I didn’t think that we will need my guide so soon but here we are. I offer nine steps on how to navigate any stock market crash.

- If you are a conservative investor, who mostly invests in bonds, you were probably somewhat sheltered from the March Market Madness. However, the future for income-seeking investors is cloudy. Current bond yields cannot support future bond investors and will likely deteriorate the economy. For more information on how to traverse from here, read my article on “Why negative interest rates are bad for your portfolio”

- Amid market volatility and uncertainty, dividend growth ETFs can provide some shelter. In my latest article “Top 5 Dividend Growth ETFs” I discuss five ETF strategies that offer lower volatility and extra income.

Final words

If you have any questions about your investments and how to update your financial plan, feel free to reach out. if you are worried about finances I am here to listen and help.