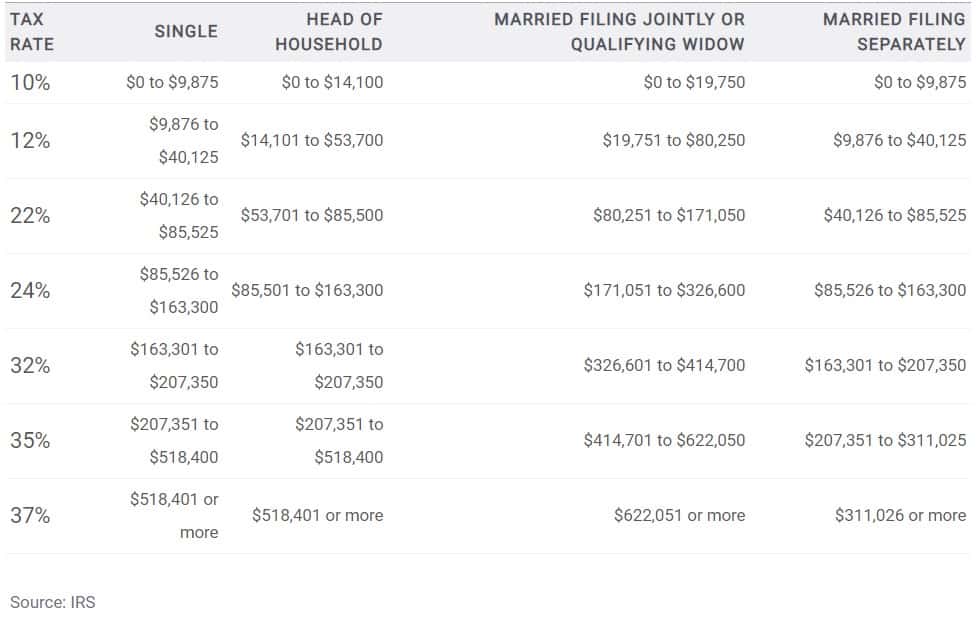

In this blog post, I will go over several popular and some not so obvious tax deductions and strategies that can help you decrease your annual tax burden. Let’s be honest. Nobody wants to pay taxes. However, taxes are necessary to pay for pensions, social services, Medicaid, roads, police, law enforcement and so on. Most people will earn a higher income and grow their investments portfolios as their approach retirement. Thus they will gradually move to higher tax brackets and face a higher tax bill at the end of the year. IRS provides many tax deductions and breaks that can help you manage your tax burden. Taking advantage of these tax rules can help you reduce your current or future your tax bill.

These are general rules. I realize that we all face different circumstances. Use them as a broad guideline. Your particular situation may require a second opinion by an accountant, a tax lawyer or an investment advisor.

1. Primary residence mortgage deductions

Buying a first home is a big decision. Your new neighborhood, school district, nearby services are all critical factors you need to consider before making your choice. If you own a primary residence (sorry, a vacation home in Hawaii doesn’t count), you can deduct the interest on your mortgage loan from your taxable income for the year. Your property taxes are also deductible. These incentives are provided by the Federal and state governments to encourage more families to buy their home.

There are two additional benefits of having a mortgage and being a responsible borrower. First, your credit score will increase. Making regular payments on your mortgage (or any loan) improves your credit history, increases your FICO score and boosts your creditworthiness. Your ability to take future loans at a lower rate will significantly improve. Second, your personal equity (wealth) will increase as you pay off your mortgage loan. Your personal equity is a measure of assets minus your liabilities. Higher equity will boost your credit score. It is also a significant factor in your retirement planning.

Buying a home and applying for a mortgage is a long and tedious process. It requires a lot of legwork and documentation. After the financial crisis in 2008 banks became a lot stricter in their requirements for providing mortgage loans to first buyers. Nevertheless, mortgage interest on a primary residence is one of the biggest tax breaks available to taxpayers.

2. Home office deductions

Owning a home versus renting is a dilemma for many young professionals. While paying rent offers flexibility and lower monthly cash payments it doesn’t allow you to deduct your rent from your taxes. Rent is usually the highest expense in your monthly budget. It makes up between 25% and 35% of your total income. The only time you can apply your rent as a tax deduction is if you have a home office.

A home office is a dedicated space in your apartment or house to use for the sole purpose of conduction your private business. It’s usually a separate room, basement or attic designated for your business purposes.

The portion of your office to the total size of your home can be deductible for business purposes. If your office takes 20% of your home, you can deduct 20% of the rent and utility bills for business expense purposes.

3. Charitable donations

Monetary and non-monetary contributions to religious, educational or charitable organization approved by IRS are tax deductible. The annual limit is 50% of your AGI (aggregate gross income) for most donations and 30% of AGI for appreciated assets.

Most often people choose to give money. However, you can also donate household items, clothes, cars, and airline miles. The fair value of the donated items decreases your taxable income and therefore will reduce the amount of taxes due to IRS.

Another alternative is giving appreciated assets including stocks and real estate. This is one of the best ways to avoid paying significant capital gain tax on low-cost investments. For one, you are supporting a noble cause. Second, you are not paying taxes for the difference between the market value and purchase cost of your stock. Also, the fair market value of the stock at the time of donation will reduce your taxable income, subject to 30% of AGI rule. If you were to sell your appreciated assets and donate the proceeds to your charity of choice, you would have to pay a capital gain tax on the difference between market value and acquisition cost at the time of sale. However, if you donate the investments directly to the charity, you avoid paying the tax and use the market value of the investment to reduce your taxable income.

4. Gifts

Making a gift is not a standard tax deduction. However, making gifts can be a way to manage your future tax payments and pass on the tax bill to family members who pay a lower tax rate. You can give up to $14,000 to any number of people every year without any tax implications. Amounts over $14,000 are subject to the combined gift and estate tax exemption of $5.49 million for 2017. You can give your child or any person within the annual limits without creating create any tax implications.

Another great opportunity is giving appreciated assets as a gift. If you want to give your children or grandchildren a gift, it is always wise to consider between giving them cash or an appreciated asset directly. Giving appreciated assets to family members who pay a lower tax rate doesn’t create an immediate tax event. It transfers the tax burden from the higher rate tax giver to the lower tax rate receiver.

5. 529 Plans

One of the best examples of how gifts can minimize future tax payments is the 529 college tuition plan. Parents and grandparents can contribute up to $14,000 annually per person, $28,000 per married couple into their child college education fund. The plan even allows a one–time lump sum payment of $70,000 (5 years x $14,000).

529 contributions are not tax deductible on a federal level. However, many states like New York, Massachusetts, Illinois, etc. allow for state tax deductions up to a certain amount. The plan allows your contributions (gifts) to grow tax-free. Withdrawals are also tax-free when using the money to pay qualified college expenses.

6. Tax-deferred contributions to 401k, 403b, and IRA

One of my favorite tax deductions is the tax-deferred contribution to 401k and 403b plans. In 2017 the allowed maximum contribution per person is $18,000 plus an additional $6,000 catch-up for investors at age 50 and older. In addition to that, your employer can contribute up to $36,000 for a total annual contribution of $54,000 or $60,000 if you are older than 50.

Most companies offer a matching contribution of 5%-6% of your salary and dollar limit of $4,000 – $5,000. At a very minimum, you should contribute enough to take advantage of your company matching plan. However, I strongly recommend you to set aside the entire allowed annual contribution.

The contributions to your retirement plan are tax deductible. They decrease your taxable income if you use itemized deductions on your tax filing form. Not only that, the investments in your 401k portfolio grow tax-free. You will owe taxes upon withdrawal at your current tax rate at that time.

If you invest $18,000 for 30 years, a total of $540,000 contributions, your portfolio can potentially rise to $1.5m in 30 years at 6% growth rate. You will benefit from the accumulative return on your assets year after year. Your investments will grow depending on your risk tolerance and asset allocation. You will be able to withdraw your money at once or periodically when you retire.

7. Commuter benefits

You are allowed to use tax-free dollars to pay for transit commuting and parking costs through your employer-sponsored program. For 2017, you can save up to $255 per month per person for transit expenses and up to $255 per month for qualified parking. Qualified parking is defined as parking at or near an employer’s worksite, or at a facility from which employee commutes via transit, vanpool or carpool. You can receive both the transit and parking benefits.

If you regularly commute to work by a bike you are eligible for $20 of tax-free reimbursement per month.

By maximizing the monthly limit for both transportation and parking expenses, your annual cost will be $6,120 ($255*2*12). If you are in the 28% tax bracket, by using the commuter benefits program, you will save $1,714 per year. Your total out of pocket expenses will be $ 4,406 annually and $367 per month.

8. Employer-sponsored health insurance premiums

The medical insurance plan sponsored by your employer offers discounted premiums for one or several health plans. If you are self-employed and not eligible for an employer-sponsored health plan through your spouse or domestic partner, you may be able to deduct your health insurance premiums. With the rising costs of health care having a health insurance is almost mandatory. Employer-sponsored health insurance premiums can average between $2,000 for a single person and 5,000 for a family per year. At a 28% tax rate, this is equal to savings between $560 and $1,400. Apart from the tax savings, having a health insurance allows you to have medical services at discounted prices, previously negotiated by your health insurance company. In the case of emergency, the benefits can significantly outweigh the cost of your insurance premium.

9. Flexible Spending Account

Flexible Spending Account (FSA) is a special tax-advantaged account where you put money aside to pay for certain out-of-pocket health care costs. You don’t pay taxes on these contributions. This means you will save an amount equal to the taxes you would have paid on the money you set aside. The annual limit per person is $2,600. For a married couple, the amount can double to $5,200. The money in this account can be used for copayments, new glasses, prescription medications and other medical and dental expenses not covered by your insurance. FSA accounts are arranged and managed by your employer and subtracted from your paycheck.

Let’s assume that you are contributing the full amount of $2,600 per year and your tax rate is 28%. You effectively save $728 from taxes, $2,550 * 28%. Your actual out-of-pocket expense is $1,872.

One drawback of the FSA is that you must use the entire amount in the same tax year. Otherwise, you can lose your savings. Some employers may allow up to 2.5 months of grace period or $500 of rollover in the next year. With that in mind, if you plan for significant medical expenses, medication purchases or surgery, the FSA is a great way to make some savings.

10. Health Spending Account

A health savings account (HSA) is a tax-exempt medical savings account available to taxpayers who are enrolled in a high-deductible health plan (HDHP) The funds contributed to this account are not subject to federal income tax at the time of deposit. Unlike a flexible spending account (FSA), HSA funds roll over and accumulate year over year if not spent. HSA owners can use the funds to pay for qualified medical expenses at any time without tax liability or penalty. The annual contribution limits are $3,350 per person, $6,750 per family and an additional $1,000 if 55 or older. The owner of HSA can invest the funds similarly to IRA account and withdraw without penalty when used for medical expenses.

11. Disability insurance

Disability premiums are generally not deductible from your tax return. They are paid with after-tax dollars. Therefore, any proceeds received as a result of disability are tax-free. The only time your benefits are taxable is when your employer pays your disability insurance and does not include it in your gross income.

12. Life insurance

Life insurance premiums are typically not deductible from your tax return if you are using after-tax dollars. Therefore, any proceeds received by your beneficiaries are tax-free.

Life insurance benefits can be tax deductible under an employer-provided group term life insurance plan. In that case, the company pays fully or partially life insurance premiums for its employees. In that scenario, amounts more than $50,000 paid by your employer will trigger a taxable income for the “economic value” of the coverage provided to you.

If you are the owner of your insurance policy, you should make sure your life insurance policy won’t have an impact on your estate’s tax liability. In order to avoid having your life insurance policy affecting your taxes, you can either transfer the policy to someone else or put it into a trust.

13. Student Loan interest

If you have student loans and you can deduct up to $2,500 of loan interest. To use this deduction, you must earn up to $80,000 for a single person or $165,000 for a couple filing jointly. This rule includes you, your spouse or a dependent. You must use the loan money for qualified education expenses such as tuition and fees, room and board, books, supplies, and equipment and other necessary expenses (such as transportation)

14. Accounting and Investment advice expenses

You may deduct your investment advisory fees associated with your taxable account on your tax return. You can list them on Schedule A under the section “Job Expenses and Certain Miscellaneous Deductions.” Other expenditures in this category are unreimbursed employee expenses, tax preparation fees, safe deposit boxes and other qualifying expenses like professional dues, required uniforms, subscriptions to professional journals, safety equipment, tools, and supplies. They may also include the business use of part of your home and certain educational expenses. Investment advisory fees are a part of the miscellaneous deduction. The entire category is tax deductible if they exceed 2% of your adjusted gross income for the amount in excess.

About the Author: Stoyan Panayotov, CFA is a fee-only financial advisor based in Walnut Creek, CA. His firm Babylon Wealth Management offers fiduciary investment management and financial planning services to individuals and families.

Disclaimer: Past performance does not guarantee future performance. Nothing in this article should be construed as a solicitation or offer, or recommendation, to buy or sell any security. The content of this article is a sole opinion of the author and Babylon Wealth Management. The opinion and information provided are only valid at the time of publishing this article. Investing in these asset classes may not be appropriate for your investment portfolio. If you decide to invest in any of the instruments discussed in the posting, you have to consider your risk tolerance, investment objectives, asset allocation and overall financial situation. Different investors have different financial circumstances, and not all recommendations apply to everybody. Seek advice from your investment advisor before proceeding with any investment decisions. Various sources may provide different figures due to variations in methodology and timing, Image Copyright: www.123rf.com

Robo-advisors have grown in popularity in the last 10 years, offering easy and inexpensive access to professional investment management with human interaction. Firms like Vanguard, Betterment, Personal Capital, and Wealth Front use online tools and algorithms to build and manage your investment. These digital advisors attract new customers with cutting-edge technology, attractive websites, interactive features, low fees, and cool mobile apps. The rising adoption of robo-advisors and various digital platforms allows the financial industry to become more accessible and consumer-friendly.

Robo-advisors have grown in popularity in the last 10 years, offering easy and inexpensive access to professional investment management with human interaction. Firms like Vanguard, Betterment, Personal Capital, and Wealth Front use online tools and algorithms to build and manage your investment. These digital advisors attract new customers with cutting-edge technology, attractive websites, interactive features, low fees, and cool mobile apps. The rising adoption of robo-advisors and various digital platforms allows the financial industry to become more accessible and consumer-friendly.