ASSET Management

Babylon Wealth Management provides comprehensive asset management and financial planning. Our firm is a fiduciary financial advisor for busy professionals in the San Francisco Bay Area and nationally. We are committed to bringing simplicity to your complex investment decisions. Our mission is to provide you with unbiased and trustworthy financial advice to help you make well-informed decisions considering your financial goals, risk management, and tax implications.

Why we are different?

Babylon Wealth Management is a fiduciary financial advisor committed to providing personalized, tax-efficient asset management services that are in your best interest only. With a diverse background in accounting and investing, we can help you manage your investment and retirement portfolio and maximize your financial outcome.

Your asset management goals are unique.

As a financial advisor to busy professionals, we understand that everyone’s individual circumstances are unique. We will build your investment portfolio tailored to your individual needs and objectives.

Personalized Focus

Our investment strategy is tailored to your financial goals, milestones, and risk tolerance level. Leave the hard work to us and spend time on what matters most to you.

Tax Efficiency

Having an investing and accounting background gives us the unique ability to help you navigate through complex financial decisions, minimize your tax burden, and maximize your earnings potential.

Diversification

We believe in portfolio diversification as a way to reduce your investment risk and offer broad exposure to multiple industries and sectors.

Passive Indexing

Passive investing is a long-term wealth-building strategy that involves buying and holding securities that mirror the stock market. We can achieve this by buying low-cost index funds or building baskets of securities that reflect the performance of the S&P 500 and other indices.

Active Beta

For clients with more complex needs, we offer active beta investing, which allows us to make tactical and strategic moves toward companies and sectors with strong secular growth.

Our Asset Management Strategy

Unlock the value of your investment portfolio

Quality momentum – Momentum investing scans for stocks with strong recent performance while assessing quality factors such as company fundamentals, management, price upside, and technical levels.

Value – Value Investing looks for underappreciated and undervalued stocks that trade below their fundamental value. Value companies generally report below-market average price-to-earnings and free cash flow metrics while maintaining strong profitability and return on capital.

Dividend – Dividend Investing selects stocks with an outstanding dividend-paying track record, strong balance sheet, and profitability.

Low volatility – We love companies that do well in all economic cycles and market conditions. These stocks typically experience below-average price fluctuations.

Growth at a reasonable price – Growth investing at a reasonable price looks for growth companies with consistent revenue and earnings growth while maintaining strong fundamentals and competitive profitability and cash flow metrics.

Insider activity—One of our long-time favorite strategies is tracking insider activity. Corporate insiders sell their company stocks for various reasons, including liquidity, taxes, and diversification. They only buy for one reason—to make money because they believe their company is undervalued.

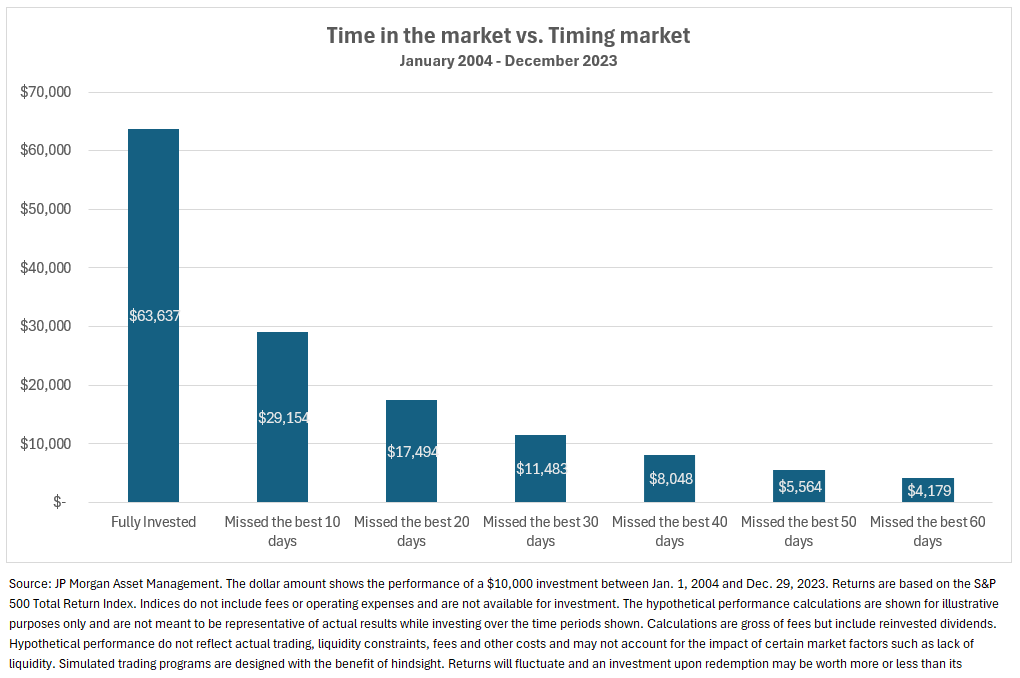

Time in the market vs. Timing the market

When it comes to investing, the question of “time in the market” versus “timing the market” is crucial. At Babylon Wealth Management, we emphasize the importance of staying invested for the long term rather than trying to predict short-term market movements. “Time in the market” allows investors to benefit from compound growth and ride out market volatility. Historically, the market has trended upward over time, and being consistently invested ensures you capture those key periods of growth that can have a significant impact on your portfolio.

In contrast, “timing the market” involves attempting to buy low and sell high, which is extremely difficult to do consistently. Even experienced investors can struggle with this approach, often missing out on market rallies or selling during downturns. While timing the market may seem appealing, the risk of mistiming can lead to missed opportunities or unnecessary losses.

Research consistently shows that long-term investors who stay the course tend to achieve better results than those who attempt to time the market. At Babylon Wealth Management, our approach is rooted in helping clients build wealth through disciplined, long-term strategies that focus on growth, stability, and peace of mind rather than chasing short-term gains.

ASSET MANAGEMENT Services

Wealth

Management

Babylon Wealth Management is a boutique financial advisor for tech professionals in the San Francisco Bay Area. Our wealth management platform offers hard working professionals and their families a unique one-stop solution combining personalized financial planning, expert asset management, tax-smart asset management, estate planning, tax advisory, and risk management. We employ investment strategies geared towards your specific near-term and long-term financial needs and circumstances.

Financial

Planning

Our comprehensive financial planning is an ideal solution for do-it-yourself professionals who need some initial guidance. Our personalized advisory service brings a comprehensive view of your personal and financial life. We will help you build a roadmap to achieve your financial goals and personal milestones by developing a tailored financial plan. Through the course of our relationship, we will provide you with a specific list of recommendations on how to achieve your priorities and objectives.

TAX SMART

INVESTING

tax-smart investing is a key strategy to help clients maximize their returns by minimizing tax liabilities. By strategically managing investments in tax-efficient accounts, utilizing tax-loss harvesting, and optimizing asset location, we aim to reduce the impact of taxes on your portfolio. This approach ensures that more of your money stays invested and compounds over time. Tax-smart investing helps protect your wealth, allowing you to achieve your financial goals more efficiently and with greater confidence.

Contact Us