Investing during election and how to beat uncertainty

Investing during election years often brings market uncertainty due to the potential for policy shifts. This uncertainty can prompt some investors to hold cash, fearing volatility, while others stay fully invested. Based on historical trends, market behavior, and investment principles, here’s a comparison of the potential benefits of fully investing during election years versus holding cash.

1. Long-Term Growth Potential:

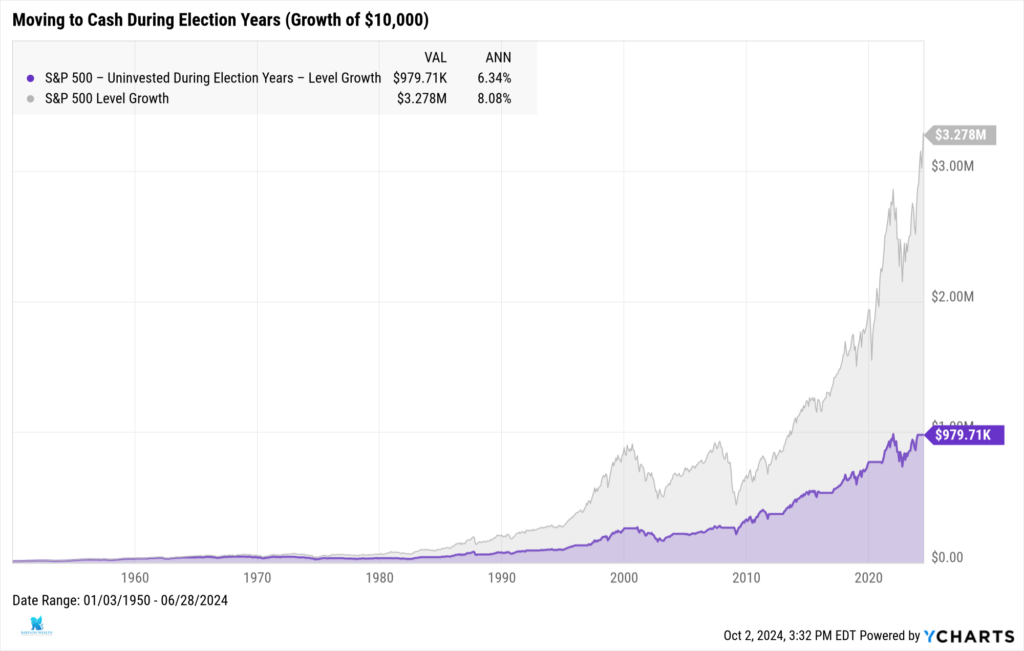

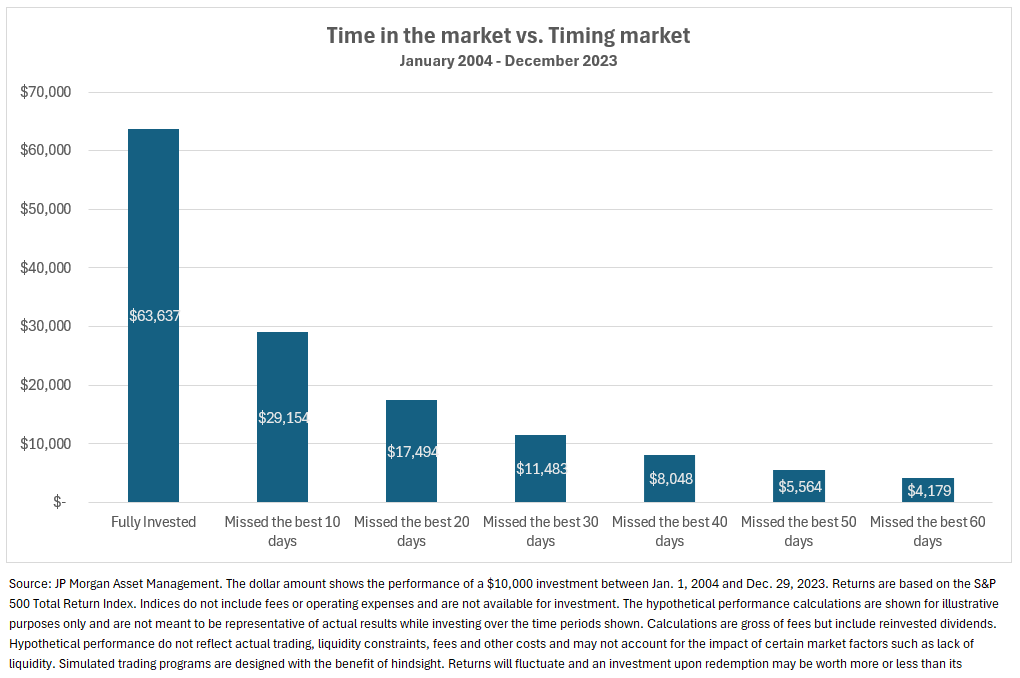

Historical data shows that staying invested through election years yields better long-term results than holding cash. The stock market has generally trended upward over time despite short-term volatility. Some of the best days in the stock market happen during times of uncertainty. Missing out on even a few of the best days in the market can significantly reduce long-term returns. You are more likely to benefit from market rebounds and potential gains by remaining fully invested.

Holding cash during election years might protect your portfolio from short-term market volatility. But it also removes the opportunity to benefit from long-term growth. Cash is considered a low-risk, low-reward strategy. While it can provide safety during market downturns, cash returns are minimal, especially when factoring in inflation, which erodes purchasing power over time. Historically, cash has underperformed stocks by a wide margin in the long run. In periods of high inflation or low-interest-rate environments, the real return on cash can be negative. While your money feels safer, its value diminishes over time due to the rising cost of goods and services.

2. Election Years and Market Performance:

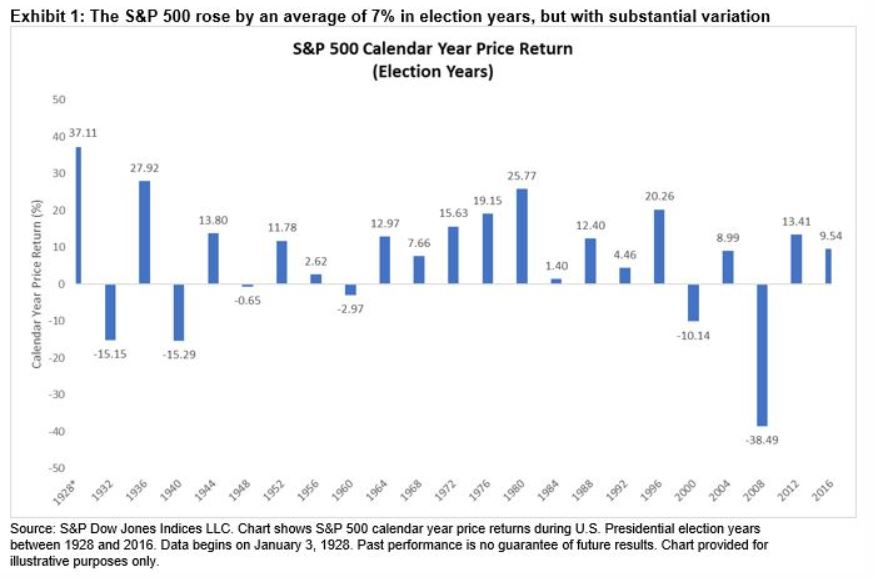

Historical data reveals that, despite pre-election volatility, the stock market tends to perform positively during election years, regardless of which party wins. Since 1928, the S&P 500 has had positive returns in 19 of 24 election years (through 2020). Investors who remain fully invested benefit from these long-term upward trends, even if there are short-term dips due to market uncertainty leading up to the election.

Holding cash to avoid the short-term volatility associated with election-year uncertainty means missing out on the potential upside. Market volatility tends to spike during the months leading up to an election, but markets have typically stabilized and continued their upward trajectory after election outcomes become more evident. You may avoid temporary losses by holding cash, but you also risk missing the post-election rally.

In 2016, many investors were uncertain about the outcome of the Trump-Clinton election. The S&P 500 dropped 5% in the futures market the night Trump won, but it quickly recovered, gaining around 11% by the end of the year. Investors who held cash missed out on these gains.

3. Impact of Policy on Different Sectors:

Elections bring uncertainty over potential policy changes affecting specific sectors (e.g., healthcare, energy, defense). While some industries may experience volatility based on candidate policies, diversified portfolios tend to mitigate the risks of sector-specific downturns. Being fully invested across a broad range of sectors helps capture growth in those that benefit from new policies while minimizing exposure to underperforming sectors.

In the 2020 election, sectors like renewable energy and technology benefited from the expectation of policy changes under a Biden administration, while traditional energy stocks faced pressure. A diversified portfolio could capture gains in the rising sectors while buffering against losses in others.

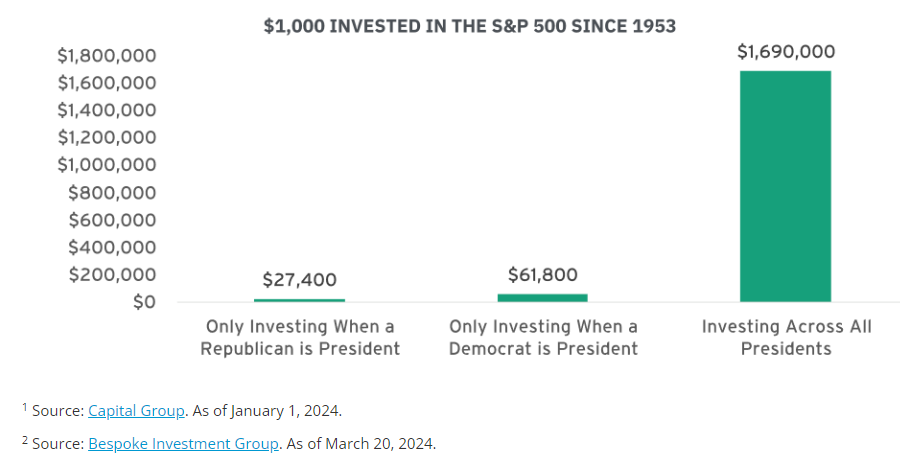

Cash is often viewed as a safe haven when investors are uncertain about how different policies will affect markets. However, staying in cash avoids potential gains in sectors that might benefit from election results. Historically, markets have adapted to new administrations, whether Democratic or Republican. Holding cash prevents investors from profiting from policy-driven sector booms.

4. Inflation and Cash Returns:

Over time, stocks tend to outpace inflation, providing a real return on investment. Election-year volatility is often short-lived while inflation continues to erode purchasing power. Remaining fully invested allows your portfolio to grow and offset the long-term effects of inflation.

Example: Over the last century, U.S. equities have delivered an average return of around 7–10% annually, far outpacing inflation, averaging 2–3%. Staying invested, even during volatile periods, is essential to maintaining and growing wealth.

Holding cash in an election year can feel safe. However, inflation often outpaces cash returns, especially in periods of low interest rates. Even with rising rates, the real return on cash may not keep up with inflation. The purchasing power of cash declines after factoring in taxes. In uncertain times, inflation-proofing your portfolio through asset growth is critical.

5. Emotional Investing and Market Timing:

Staying fully invested during election years helps avoid emotional investing and the pitfalls of market timing. Many investors attempting to time the market, selling before an expected downturn and buying back after stability returns, often miss out on significant gains. Historical data shows that missing even a few of the best trading days can devastate portfolio returns. Remaining invested through the volatility of elections helps investors avoid costly timing mistakes.

Investors holding cash during election years might feel they are avoiding risk, but market timing is notoriously difficult. Trying to predict when to re-enter the market can lead to missed opportunities, especially as markets tend to recover quickly after short-term dips. Holding cash may also increase the temptation to “wait for the perfect moment,” which rarely happens, leading to lost growth potential.

Investing during election vs. holding cash:

While holding cash during an election year can provide short-term protection from volatility, the long-term benefits of fully investing during election outweigh the perceived safety of cash

Historical trends indicate that election-year volatility is usually short-lived. Markets tend to recover and even thrive, regardless of political outcomes. Staying fully invested allows investors to capture long-term market growth, take advantage of policy-driven sector gains, and avoid the detrimental effects of market timing.

On the other hand, holding cash can protect against short-term losses. Unfortunately, cash typically underperforms due to inflation, taxes, and the opportunity cost of missing market rebounds. While cash might feel safer during uncertain times, Fully investing during elections has consistently proven to be a more effective strategy for growing wealth over the long term, especially in the context of the stock market’s resilience and historical upward trend.

In essence, staying fully invested through election cycles allows investors to benefit from the market’s ability to adapt, whereas holding cash can mean missing out on the gains that drive long-term financial success.

Contact Us