Market Outlook April 2018

Market Outlook April 2018

After a record high 2017, the volatility has finally returned. Last year the market experienced one of the highest risk-adjusted performances in recent history. In 2017 there were only 10 trading where the S&P 500 moved by more than 1% in either direction, with not a single trading day when it moved by more than 2%. In contrast, in the 61 trading days of Q1 of 2018, we had 26 days when the S&P 500 moved by more than 1% and 8 days where it changed by more than 2%.

Learn more about our Private Wealth Management services

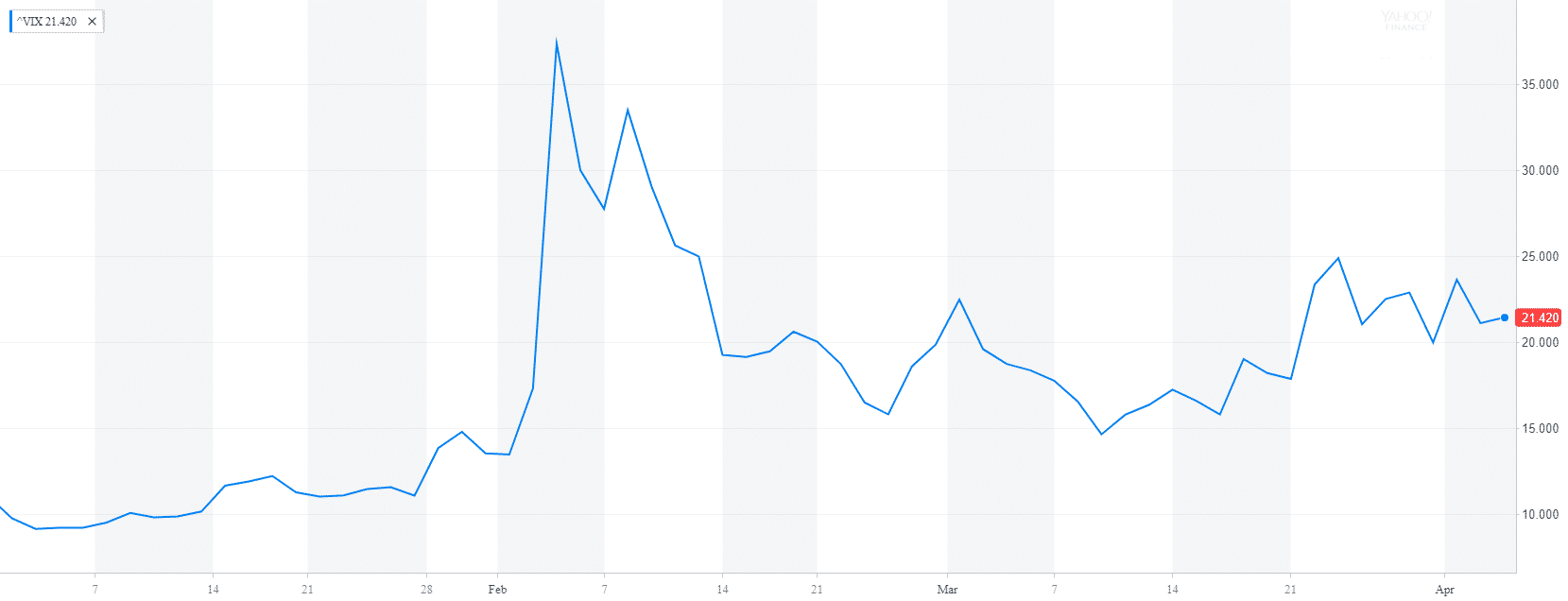

VIX Index Q1 2018

The VIX Index, which measures the volatility of the S&P 500 started the year ar 9.77. It peaked at 37.33 and ended the quarter at 19.97.

Markets do not like uncertainty, and so far, Q1 had plenty of that. In the first 3 months of the year market landscape was dominated by news about rising inflation and higher interest rates, the Toys R Us bankruptcy, trade war talks and tariffs against China, and scandals related to Facebook user data privacy.

Except for Gold, all major market indices finished in the negative territory.

| Index | Q1 2018 |

| S&P 500 | -1.00% |

| Russell 2000 | -0.18% |

| MSCI EAFE | -0.90% |

| Barclays US Aggregate Bond Index | -1.47% |

| Gold | +1.73% |

Fixed Income

Traditionally bonds have served as an anchor for equity markets. Over time stocks and US Treasury bond have shown a negative correlation. Usually, bonds would rise when stocks prices are falling as investors are moving to safer investments. However, in 2018 we observed a weakening of this relationship. There were numerous trading days when stocks and bonds were moving in the same direction.

On the other hand, despite rising interest rates, we see the lowest 10-year/2-year treasury spread since the October of 2007. The spread between the two treasury maturities was 0.47 as of March 29, 2018. While not definite, historically negative or flat spreads have preceded an economic recession.

Momentum

Momentum remained one of the most successful strategies of 2018 and reported +2.97%. Currently, this strategy is dominated by Technology, Financials, Industrials, and Consumer Cyclical stocks. Some of the big names include Microsoft, JP Morgan, Amazon, Intel, Bank of America, Boeing, CISCO, and Mastercard.

Value

Value stocks continued to disappoint and reported -3.73% return in the Q1 of 2018. Some of the biggest names in this strategy like Exxon Mobile, Wells Fargo, AT&T, Chevron, Verizon, Citigroup, Johnson & Johnson, DowDuPont and Wall-Mart fell close to or more than -10%. As many of these companies are high dividend payers, rising interest rates have decreased the interest of income-seeking investors in this segment of the market.

Small Cap

As small-cap stocks stayed on the sideline of the last year’s market rally, they were mostly unaffected by the recent market volatility. Given that most small-cap stocks derive their revenue domestically, we expect them to benefit significantly from the lower tax rates and intensified trade war concerns.

Gold

Gold remained a solid investment choice in the Q1 of 2018. It was one of the few asset classes that reported modest gains. If the market continues to b volatile, we anticipate more upside potential for Gold.

Outlook

- We anticipate that the market volatility will continue in the second quarter until many of the above issues get some level of clarification or resolution.

- We expect that small and large-cap stocks with a strong domestic focus to benefit from the trade tariffs tension with China and other international partners

- The actual impact of lower taxes on corporate earnings will be revealed in the second half of 2018 as Q3 and Q4 earnings will provide a clear picture of earnings net of accounting and tax adjustments.

- Strong corporate earnings and revenue growth have the ability to decrease the current market volatility. However, weaker than expected earnings can have a dramatically opposite effect and drive down the already unstable markets.

- If the Fed continues to hike their short-term lending rates and inflation rises permanently above 2%, we could see a further decline in bond prices.

- Our strategy is to remain diversified across asset classes and focus on long-term risk-adjusted performance

If you have any questions about your existing investment portfolio or how to start investing for retirement and other financial goals, reach out to me at st****@ba***********.com or +925-448-9880.

About the author:

Stoyan Panayotov, CFA is the founder and CEO of Babylon Wealth Management, a fee-only investment advisory firm based in Walnut Creek, CA. Babylon Wealth Management offers personalized wealth management and financial planning services to individuals and families. To learn more visit our Private Client Services page here. Additionally, we offer Outsourced Chief Investment Officer services to professional advisors (RIAs), family offices, endowments, defined benefit plans, and other institutional clients. To find out more visit our OCIO page here.

Contact Us