Market Outlook April 2019

In my last commentary in early January, right after the December vortex, I gave 30% chance that the bull market will recover and 50% chance that we will see more volatility in the upcoming six months. My view of the economy was still positive. And I didn’t see reasons for a recession at that time. I was somewhat right and wrong. My market outlook remains cautiously positive. Let’s break it down.

Equity markets

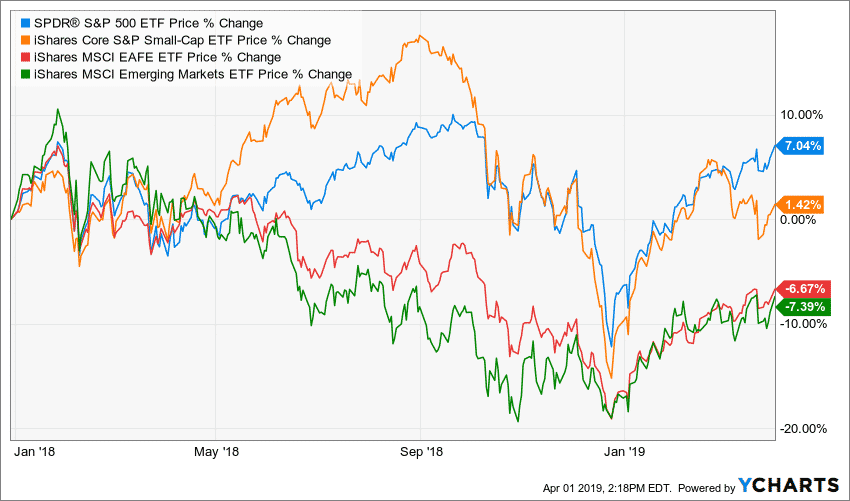

The markets were a little bit choppy at the beginning of January and the end of March. But overall all major equity markets in the US and abroad posted impressive quarterly performance. In fact, it was the S&P 500’s best quarter in decades. The S&P 500 index rose by 13% in the first three months of the year. Russell 2000 added 14.3%. The international stocks grew by about 10%.

However, to put that in perspective, the S&P 500 is still a few percentage points below its all-time high in September of 2018. At the same time, Small caps are nearly 13% below its highest mark. While International Developed and Emerging Market stocks have been in a steep decline since their highs in January of 2018 and haven’t even come close to these levels.

So, I was wrong because, despite a few volatile trading days, the market remained relatively calm. The Q1 standard deviation was well below the 10-year average. After the Fed chair Jerome Powell stated that the Fed would be more cautious in raising interest rates in 2019 after their initial forecast of three rate hikes, the market took a leap of faith.

The US and international markets continue to diverge. The chart above shows the difference in performance between these two markets.

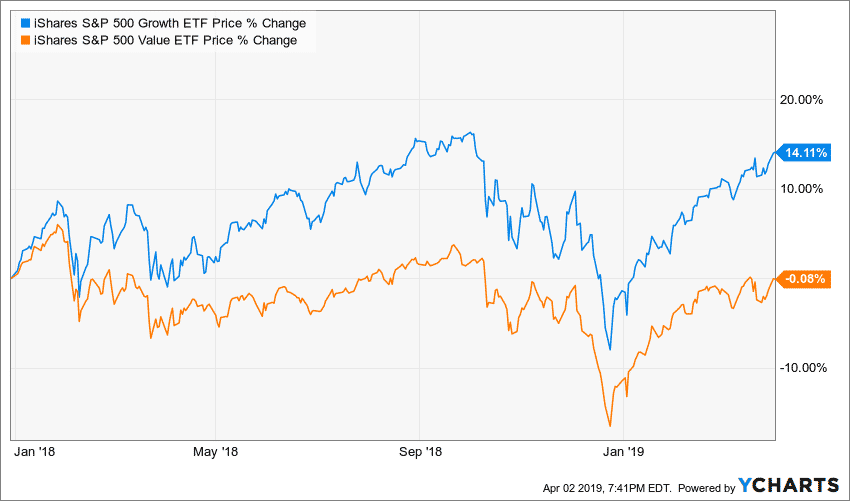

Growth versus value

Another interesting story is the growing gap between Growth and Value stocks. Value stocks have done pretty much nothing in the past 15 months while growth stocks have been a power horse.

The trade wars

We also got mixed but mostly positive news from the US-China trade negotiations. The investors want the deal, and both sides seem motivated to strike one. The truth is that the US is the biggest market for Chinese export and China is the biggest market for US tech and industrial giants. However, a lot of the issues with intellectual property and copyright protection, government subsidies and influence on corporate boards, privacy concerns, limited market access to China for US companies and so on, have accumulated for decades. But It will take more than a handshake to get these issues resolved.

Fixed Income Markets

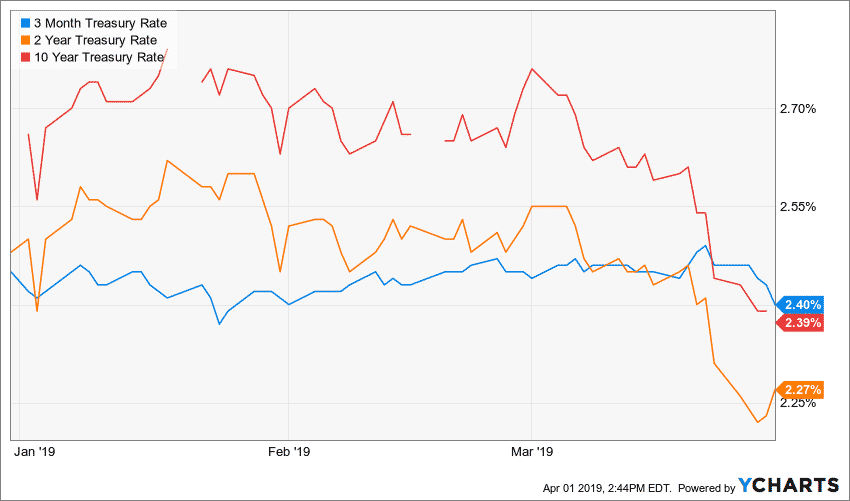

The fixed-income traders have probably seen better days. For the first time in over a decade, the 10-year treasury rate is lower than the 3-month treasury rates. The maturity premium is now negative. This type of rate tightness is known as an inverted yield curve. The yield inversion has historically preceded all economic recessions. But not all inverted yield curves have led to a recession.

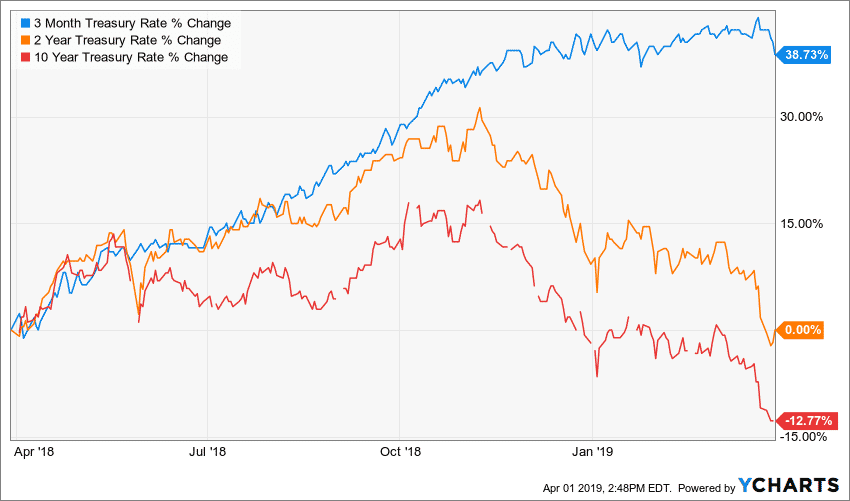

This second chart below shows the gap between the Fed and Wall Street on their view of the world. The Fed who can only influence the short-end of the curve by its lending window has pushed the short-term rates by nearly 39% in the past 12 months. Those of us with saving accounts are finally seeing decent rates after ten years of drought.

However, the long end of the curve, which is primarily determined by market supply and demand has declined by almost 12%

Soft landing or recession

The fixed income markets are waiving the red flag while the equity market remains positive. Somebody must be wrong.

Negative signals

I see a mixed bag of both positive and negative signals. On one side, US and Chinese economies continue to grow steady though with a slower pace. US Q4 GDP growth was 2.4% down from 3.4% in the third quarter of 2018. The Chinese economy expanded 6.6 percent in 2018, which is the weakest pace since 1990.

Furthermore, according to FactSet, the S&P 500 EPS estimate dropped by 7.2% (to $37.33 from $40.21) during Q1 of 2019. The decline in EPS was larger than the 5-year average (3.2%), the 10-year (3.7%), and the 15-year average (4%) cut. Additionally, payroll slowdown below forecast in the third quarter, hitting an 18-month low in March.

On the other track, Germany posted only 0.6% YoY GDP growth in 2018 with a nearly zero growth in the Q4 of 2018. Japan reported a 0.3% annual growth, after contracting -0.6% in Q3 of 2018. Earlier in March ECB’s Mario Draghi said that there had been a “sizable moderation in economic expansion that will extend into the current year.” The ECB lowered its growth forecast for 2019 from 1.7% to 1.1%. Furthermore, the ECB halted its plans to hike rates and introduced another round of financing for European banks.

Positive signals

On the positive side, new home sales posted the highest gain in February after a steep decline in the second half of 2018. The US unemployment rate remains low at 3.8%. The US consumer sentiment went up to 98.4 in March 2019 after diving in January. The Chinese PMI surpassed economists’ estimates. New orders climbed to their highest level in four months, while the index for new export orders returned to expansionary territory.

The big question remains if the US will follow the EU and Japan into a recession/stagnation mode. Or the Fed and the Trump administration will maneuver the economy into a soft landing with slower but still healthy earnings growth, high consumer sentiment and robust business spending.

What to expect

Predicting the markets could be a treacherous task. Even successful economists sometimes make wrong conclusions. Humbly, I thought that the UK and the EU will figure out a soft Brexit, while the outcome is still hanging up in the air. I also thought that the economy would not slow down so quickly, but the combination of volatile oil prices, high interest rates, and trade war rhetoric really moved the needle in the wrong direction. The next three to six months will be crucial to see if we are indeed heading into a slowdown or the economy is just taking a deep breath before going into another growth spurt.

The first quarter market recovery created an opportunity to take some risk off the table and rebalance your portfolio to your original risk tolerance targets.

What to watch

I am going to watch the performance of Growth versus Value stocks. In a world of slowing global economy, companies with a wide moat, high earnings growth, and big margins will continue to drive the markets. Separately, the flat yield curve and interest rates could boost interest in higher dividend paying stocks.

Also, I am going to watch the yield curve for significant moves in either direction. With short-term rates effectively higher than 10-year treasuries, for those sitting on extra cash, it might be tempting to get into one of those high-interest CDs. Currently, a 1-year CD is paying anywhere between 2.65% and 2.85%.

Contact Us

If you’d like to discuss how the market impacts your investments, please feel free to reach out and learn more about our fee-only financial advisory and OCIO services. We will meet you in one of our offices in San Francisco, Oakland, Walnut Creek, and Pleasant Hill areas. As a CFA® Charterholder with an MBA degree in Finance and 15+ years in the financial industry, I am ready to answer your questions.

Stoyan Panayotov, CFA

Founder | Babylon Wealth Management

Disclaimer: Past performance does not guarantee future performance. Nothing in this article should be construed as a solicitation or offer, or recommendation, to buy or sell any security. The content of this article is the sole opinion of the author and Babylon Wealth Management. The opinion and information provided are only valid at the time of publishing this article. Investing in these asset classes may not be appropriate for your investment portfolio. If you decide to invest in any of the instruments discussed in the posting, you have to consider your risk tolerance, investment objectives, asset allocation, and overall financial situation. Different investors have different financial circumstances, and not all recommendations apply to everybody. Seek advice from your investment advisor before proceeding with any investment decisions. Various sources may provide different figures due to variations in methodology and timing,

Contact Us