Market Outlook July 2019

Breaking records

So far 2019 has been the year of breaking records. We are officially in the longest economic expansion, which started in June of 2009. After the steep market selloff in December, the major US indices have recovered their losses and reached new highs. The hopes for a resolution on trade, the Fed lowering interest rates and strong US consumer spending, have lifted the markets. At the same time, many investors remain nervous fearing an upcoming recession and slowing global growth.

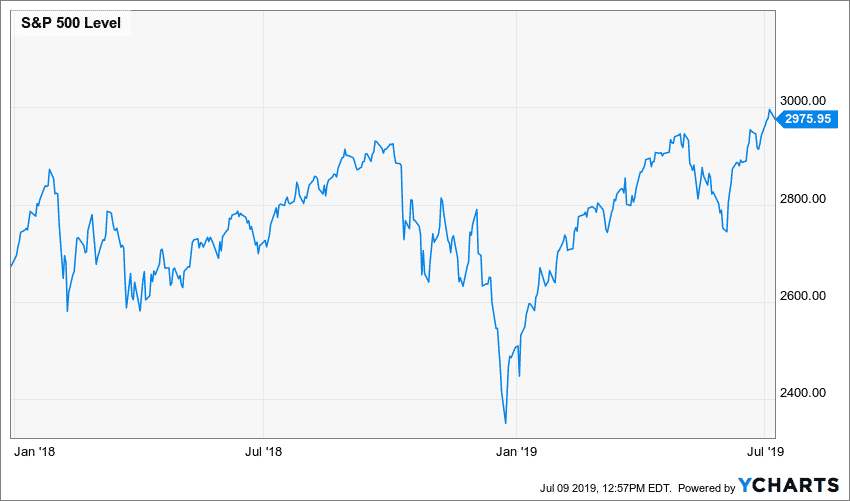

S&P 500 in record territory

S&P 500 hit an all-time high in June, which turned out to be best June since 1938. Furthermore, the US Large Cap Index had its best first quarter (January thru March) and the best first half of the year since the 1980s.

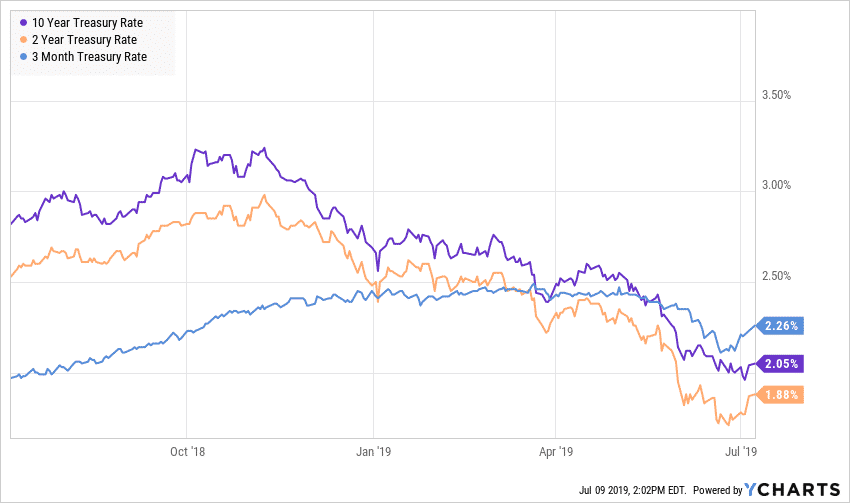

US treasuries rates declined

Despite the enthusiasm in the equity world, fixed income investors are ringing the alarm bell. 10-year treasury rate dropped under 2%, while 2-year treasuries fell as low as 1.7%.

We continue to observe a persistent yield inversion with the 3-month treasury rates higher than 2-year and 10-year rates. Simultaneously, the spread between the 2 and 10-year remains positive. Historically, a yield inversion has been a sign for an upcoming recession. However, most economists believe that the 2-10-year spread is a better indicator than the 3m-10-year spread.

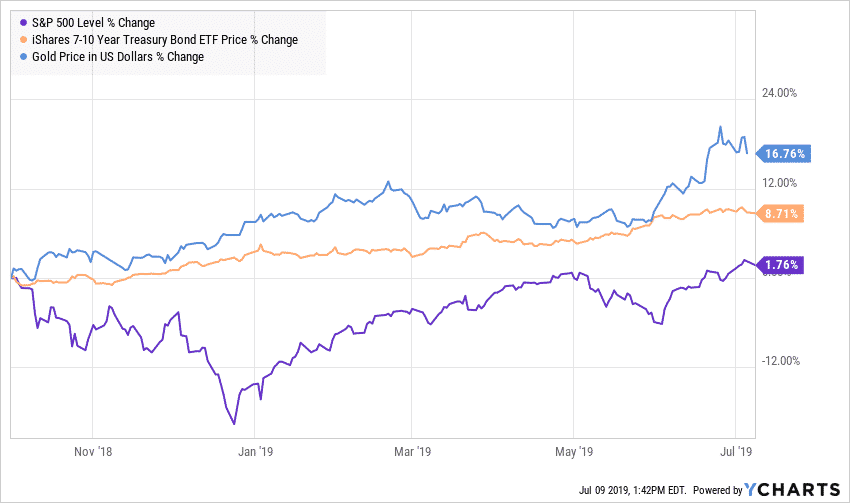

Gold is on the move

Gold passed 1,400. With increased market volatility and investors fears for a recession, Gold has made a small comeback and reached $1,400, the highest level since 2014.

Bonds beating S&P 500

Despite the record highs, S&P 500 has underperformed the Bond market and Gold from October 2018 to June 2019 S&P 500 is up only 1.8% since October 1, 2018, while the 10-year bond rose 8.7% and Gold gained 16.8%. For those loyal believers of diversification like myself, these figures show that diversification still works.

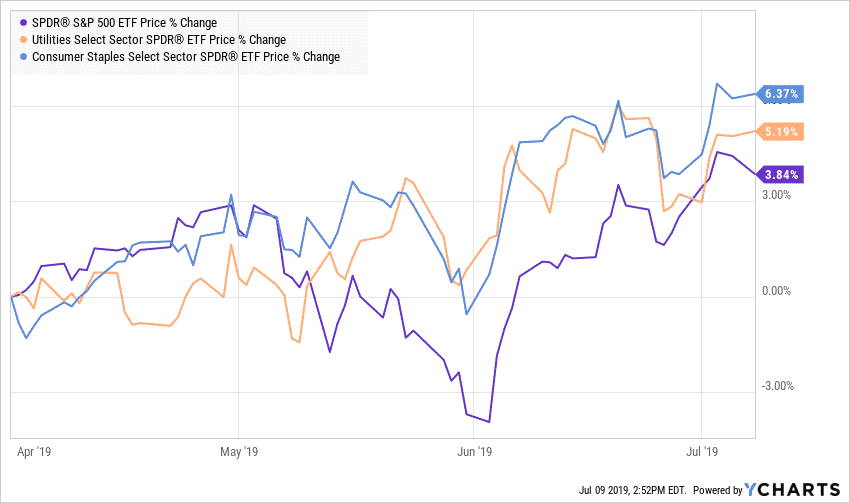

Defensive Stocks lead the rally in Q2

Consumer Staples and Utilities outperformed the broader market in Q2 of 2019. The combination of lower interest rates, higher market volatility and fears for recessions, have led many investors into a defensive mode. Consumer staples like Procter & Gamble and Clorox together with utility giants like Southern and Con Edison have led the rally in the past three months.

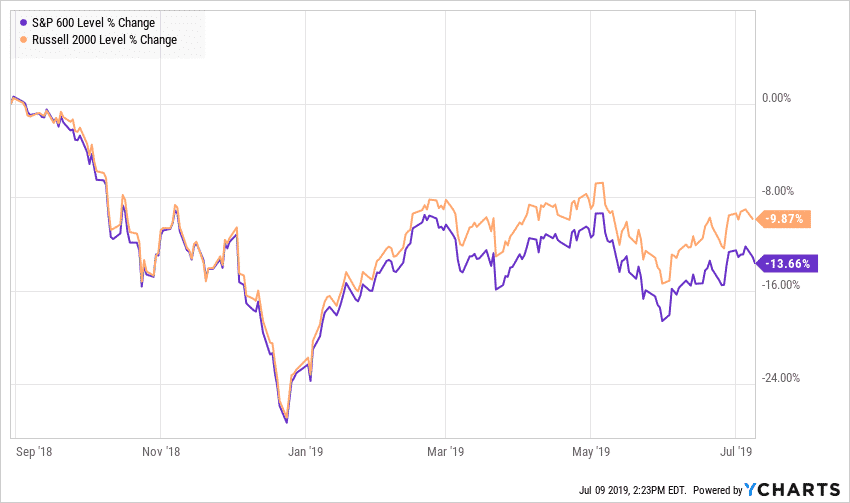

Small-Cap lagging

Small cap stocks are still under all-time high levels in August of 2018. While both S&P 600 and Russell 2000 recovered from the market selloff in December o 2018, they are still below their record high levels by -13.6% and 10% respectively

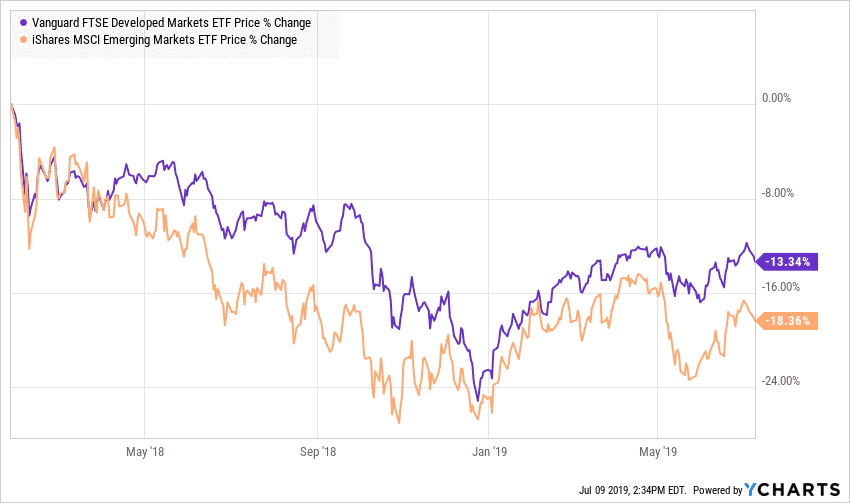

International Stocks disappoint

International Developed and Emerging Stocks have also not recovered from their record highs in January of 2018. The FTSE International Developed market index is 13.4% below its highest levels. While MSCI EM index dropped nearly 18.3% from these levels.

The Fed

After hiking their target rates four times in 2018, the Fed has taken a more dovish position and opened the door for a possible rate cut in 2020 if not sooner. Currently, the market is expecting a 50-bps to a 75-bps rate cut by the end of the year.

As I wrote this article, The Fed chairman Jerome Powell testified in front of congress that crosscurrents from weaker global economy and trade tensions are dampening the U.S. economic outlook. He also said inflation continues to run below the Fed’s 2% target, adding: “There is a risk that weak inflation will be even more persistent than we currently anticipate.”

Unemployment

The unemployment rate remains at a record low level at 3.7%. In June, the US economy added 224,000 new jobs and 335,000 people entered the workforce. The wage growth was 3.1%.

Consumer spending

The US consumer confidence remains high at 98 albeit below the record levels in 2018. Consumer spending has reached $13 trillion. Combined with low unemployment, the consumer spending will be a strong force in supporting the current economic expansion.

Manufacturing is weakening

The Institute for Supply Management (ISM) reported that its manufacturing index dropped to 51.7 in June from 52.1 in May. Readings above 50 indicate activity indicate expanding, while those below 50 show contraction. While we still in the expansion territory, June 2019 had the lowest value since 2016. Trade tensions with China, Mexico, and Europe, and slowing global growth have triggered the alarm as many businesses are preparing for a slowdown by delaying capital investment and large inventory purchases.

Trade war truce for now

The trade war is on pause. After a break in May, the US and China will continue their trade negotiations. European auto tariffs are on hold. And raising tariffs on Mexican goods is no longer on the table (for now). Cheering investors have lifted the markets in June hoping for a long-term resolution.

Dividend is the king

With interest rates remaining low, I expect dividend stocks to attract more investors’ interest. Except for consumer staples and utilities, dividend stocks have trailed the S&P 500 so far this year. Many of the dividend payers like AT&T, AbbVie, Chevron, and IBM had a lagging performance. However, the investor’s appetite for income could reverse this trend.

The 3,000

As I was writing this article the S&P 500 crossed the magical 3,000. If the index is able to maintain this level, we could have a possible catalyst for another leg up of this bull market.

The elections are coming

The US Presidential elections are coming. Health Care cost, rising student debt, income inequality, looming retirement crisis, illegal immigration, and the skyrocketing budget deficit will be among the main topics of discussion. Historically there were only four times during an election year when the stock market crashed. All of them coincided with major economic crises – The Great Depression, World War II, the bubble, and the Financial crisis. Only one time, 1940 was a reelection year.

S&P 500 Returns During Election Years

| Year | Return | Candidates |

| 1928 | 43.60% | Hoover vs. Smith |

| 1932 | -8.20% | Roosevelt vs. Hoover |

| 1936 | 33.90% | Roosevelt vs. Landon |

| 1940 | -9.80% | Roosevelt vs. Willkie |

| 1944 | 19.70% | Roosevelt vs. Dewey |

| 1948 | 5.50% | Truman vs. Dewey |

| 1952 | 18.40% | Eisenhower vs. Stevenson |

| 1956 | 6.60% | Eisenhower vs. Stevenson |

| 1960 | 0.50% | Kennedy vs. Nixon |

| 1964 | 16.50% | Johnson vs. Goldwater |

| 1968 | 11.10% | Nixon vs. Humphrey |

| 1972 | 19.00% | Nixon vs. McGovern |

| 1976 | 23.80% | Carter vs. Ford |

| 1980 | 32.40% | Reagan vs. Carter |

| 1984 | 6.30% | Reagan vs. Mondale |

| 1988 | 16.80% | Bush vs. Dukakis |

| 1992 | 7.60% | Clinton vs. Bush |

| 1996 | 23.00% | Clinton vs. Dole |

| 2000 | -9.10% | Bush vs. Gore |

| 2004 | 10.90% | Bush vs. Kerry |

| 2008 | -37.00% | Obama vs. McCain |

| 2012 | 16.00% | Obama vs. Romney |

| 2016 | 11.90% | Trump vs. Clinton |

Final words

The US Economy remains strong despite headwinds from trade tensions and slowing global growth. GDP growth above 3% combined with a possible rate cut lat and resolution of the trade negotiations with China, could lift the equity markets another 5% to 10%.

Another market pullback is possible but I would see it as a buying opportunity if the economy remains strong.

If your portfolio has extra cash, this could be a good opportunity to buy short-term CDs at above 2% rate.

Reach out

If you have any questions about the markets and your investment portfolio, reach out to me at st****@***********th.com or +925-448-9880.

You can also visit my Insights page where you can find helpful articles and resources on how to make better financial and investment decisions.

About the author:

Stoyan Panayotov, CFA, MBA is a fee-only financial advisor in Walnut Creek, CA, serving clients in the San Francisco Bay Area and nationally. Babylon Wealth Management specializes in financial planning, retirement planning, and investment management for growing families and successful business owners.

Contact Us