Category Retirement Planning

Why negative interest rates are bad for your portfolio

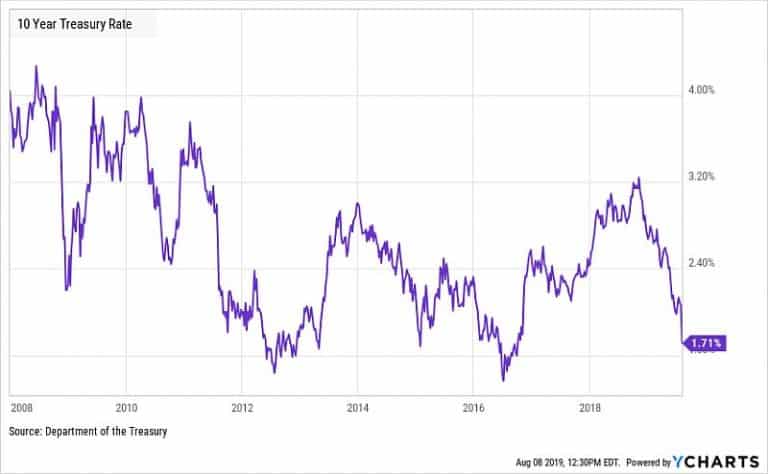

Quantitative Easing Ever since the financial crisis of 2008-2009, central banks around the world have been using lower interest rates and Quantitative Easing (QE) to combat to slow growth and recession fears. In the aftermath of the Great Recession, all…

The Secret to becoming a 401k millionaire

How to become a 401k millionaire? Today, 401k plans are one of the most popular employee benefits. Companies use 401k plans to attract top talent. 401k plan is a powerful vehicle to save for retirement and become financially independent. According…

The Smart Way to Manage Your Sudden Wealth

Getting rich is the dream of many people. When your sudden wealth becomes a reality, you need to be ready for the new responsibilities and challenges. As someone experienced in helping my clients manage their sudden wealth, I want to…

Everything you need to know about your Target Retirement Fund

Target Retirement Funds are a popular investment option in many workplace retirement plans such as 401k, 403b, 457, and TSP. They offer a relatively simple and straightforward way to invest your retirement savings as their investment approach is based on…

6 Essential steps to diversify your portfolio

Diversification is often considered the only free lunch in investing. In one of my earlier blog posts, I talked about the practical benefits of diversification. I explained the concept of investing in uncorrelated asset classes and how it reduces the…

14 Effective ways to take control of your taxes

In this blog post, I will go over several popular and some not so obvious tax deductions and strategies that can help you decrease your annual tax burden. Let’s be honest. Nobody wants to pay taxes. However, taxes are necessary…

10 Ways to reduce taxes in your investment portfolio

Successful practices to help you lower taxes in your investment portfolio A taxable investment account is any brokerage or trust account that does not come with tax benefits. Unlike Roth IRA and Tax-Deferred 401k plans, these accounts do not have many…

How to find and choose the best financial advisor near me?

Last update, August 2020……….Seeking a financial advisor near you is a significant step in achieving your personal and financial goals. Financial advisors have been instrumental in helping clients maintain a well-balanced, disciplined, long-term focused approach toward their personal finances and…

A beginner’s guide to retirement planning

Many professionals feel overwhelmed by the prospect of managing their finances. Often, this results in avoidance and procrastination– it is easy to prioritize career or family obligations over money management. Doing so puts off decision making until retirement looms. While…

Contact Us