What to expect from the stock market in 2025?

As we step into 2025, we will eagerly watch the stock market again, hoping to build on the gains of the past two years. While no one can predict market direction with absolute certainty, a combination of recent market trends, economic indicators, and investor sentiment provides a framework for setting expectations. Here’s a look at key factors and trends that could shape the market in 2025.

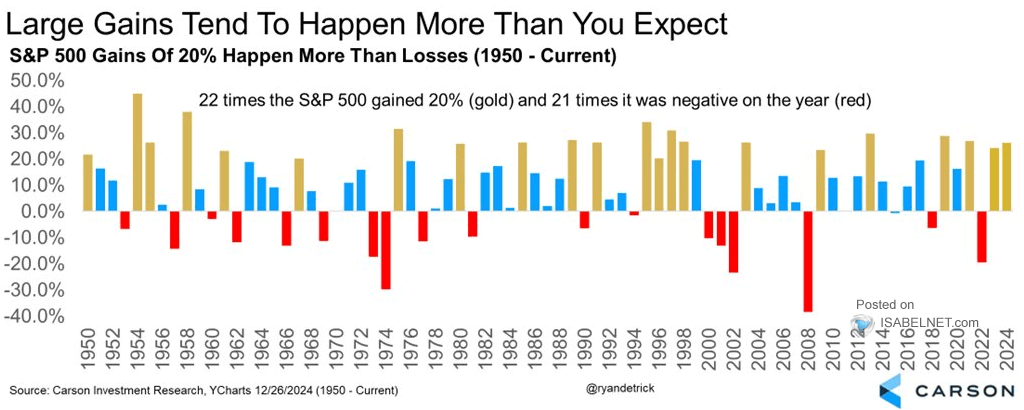

Back-to-back 20%+ gains

After a volatile bear market in 2022, the stock market experienced a swift recovery driven by AI stocks like Nvidia, Microsoft, Amazon, Alphabet, Meta, and Palantir. We recorded two years with back-to-back 20%+ gains on the S&P 500. As you can see from the chart below, periods of outsized gains are rare but not uncommon. The last expansion occurred during the late 1990s and the dot com bubble. Can we have another year with 20%+ gains? It’s possible but rather unlikely.

The market during a Presidential Cycle

Donald Trump will be the only second president in US history to have two non-consecutive terms. Therefore, no historical evidence exists of the stock market’s performance in these circumstances.

Presidents like Ronald Reagan, Bill Clinton, and Barack Obama saw strong stock market performances during their second terms, as their administrations coincided with economic growth and technological advancements. On the other hand, George W. Bush’s second term was a disaster, leading to the financial crisis of 2008 and causing a 50% crash in the stock market.

The stock market does not like uncertainty.

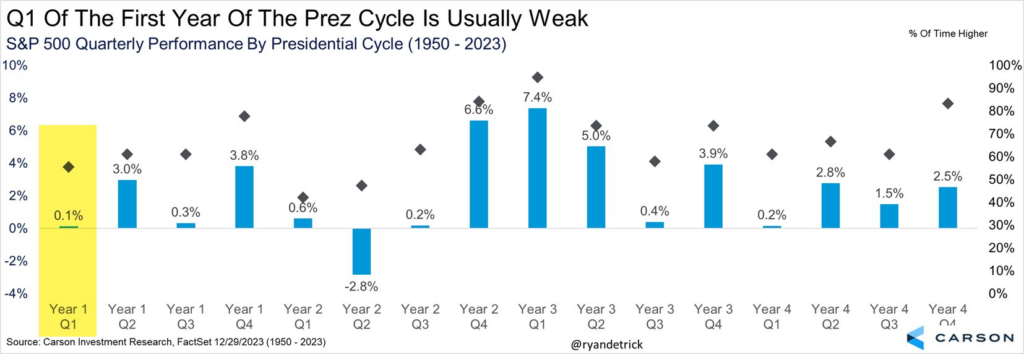

On average, the first quarter and the first year of the presidential term tend to be weak as investors adjust their expectations to the new policies. This period can lead to market volatility and uncertainty as investors try to gauge the potential impact of these changes on various sectors.

In the broader presidential cycle, the second year (mainly during mid-term elections) often sees more government intervention or stimulative measures to boost economic performance.

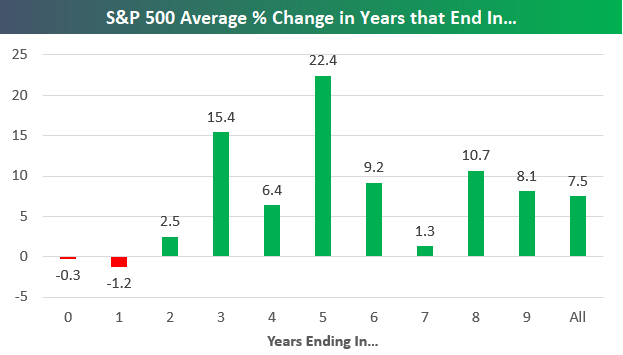

Stock market performance in years ending on 5.

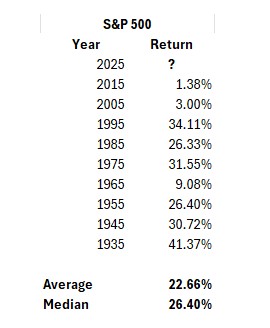

Before you get too pessimistic about 2025, here is another curious statistic. The S&P 500 has recorded a 22.4% average annual return during years ending on 5, such as 2025.

2005 and 2015 had smaller returns, but prior years ending on 5 had an impressive performance. Mid-decade periods tend to follow major fiscal or monetary interventions and policy changes earlier in the decade, stabilizing economies and boosting corporate profits. However, it could also be a case of coincidental historical data clustering without any fundamental reason.

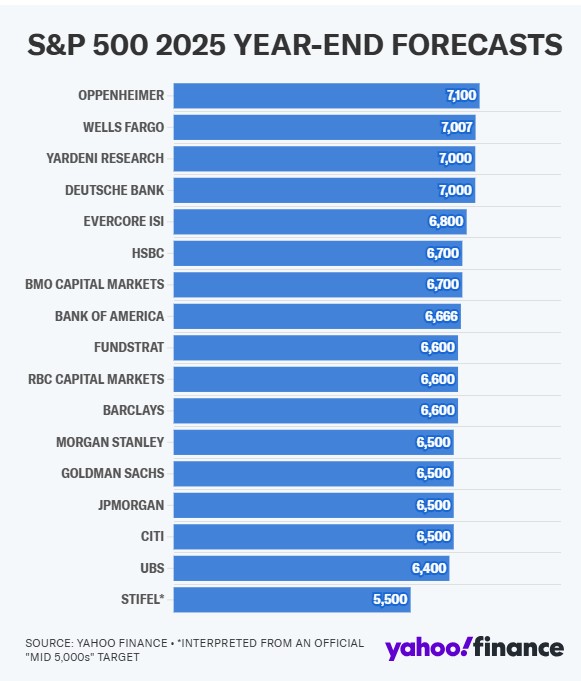

Wall Street targets

Unlike in previous years, Wall Street Analysts are mainly bullish. They predict that the S&P 500 could see gains ranging from approximately 8% to 20% in 2025. Expectations of sustainable economic expansion, earnings growth, and potential policy changes under a new Trump administration bolster Wall Street optimism.

Oppenheimer has set the highest target for the S&P 500 at 7,100 by the end of 2025. Their prediction implies a 20% return based on current monetary policy, resilient economic growth, business activity, consumer behavior, job creation, and expected earnings growth. Oppenheimer’s strategists highlight AI technology as a significant driver for this growth, suggesting it could lead to efficiency and productivity improvements across all sectors, similar to the impact of the automobile in the 1920s

Stifel is a notable outlier. Their target for the S&P 500 in 2025 is much more bearish than other Wall Street forecasts. They expect the S&P 500 to peak in the first half of 2025, then fall by 10% to 15% in the second half. They predict the index could drop to the mid-5,000s by the end of 2025. Stiffel is concerned about slowing economic growth, sticky inflation, and the potential for a correction in stock valuations.

Fundstrat’s Tom Lee has set a target for the S&P 500 to reach 7,000 by mid-2025, with an expectation that it will retreat to 6,600 by the end of 2025. His forecast suggests a steep gain from the current level, with a notable correction in the second half of 2025. Tom Lee also made the bold prediction that Bitcoin will reach $250K in 2025

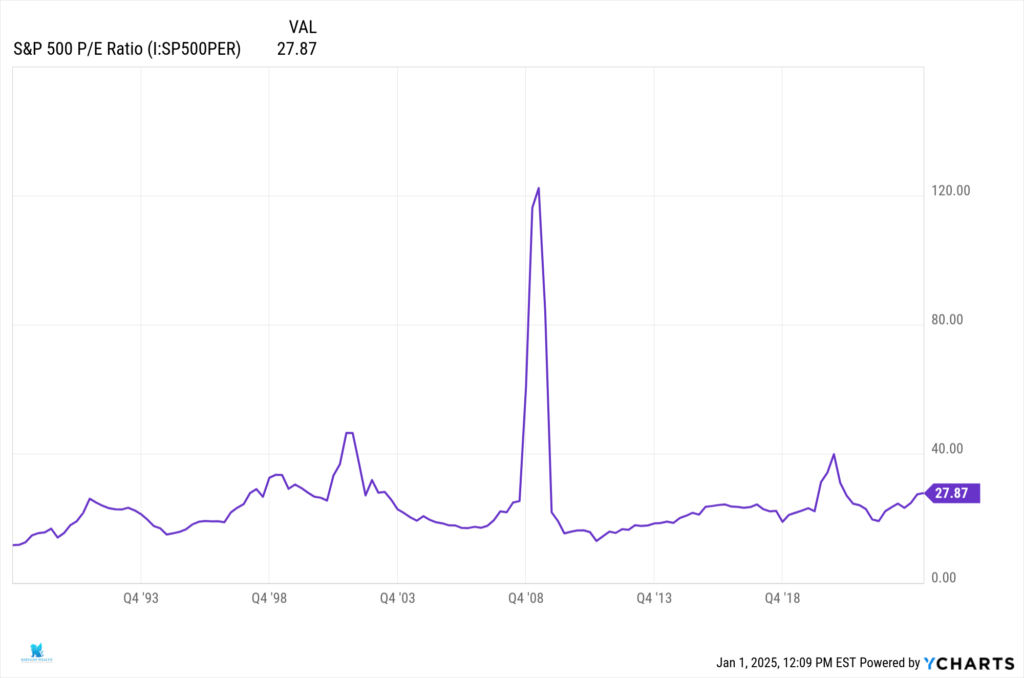

Market is expensive

The S&P 500 is expensive if you measure it by the Price to Earnings (PE Ratio), which currently stands at 27. Price to Earnings tells you the premium that you pay for stocks. High-growth stocks have high PE ratios as investors expect outsized earnings growth and higher future profits. Often, these companies don’t report any earnings while the revenue increases at a high clip.

However, slow-growth companies don’t always get a low PE.

Coca-Cola (KO), which grows by an average of 5% annually, has a 25 PE ratio. Facebook and Alphabet, which increase revenue and earnings by over 15%+ per year, have similar PE.

Ironically, the highest PE ratio on record was at the bottom of the Global Financial Crisis. The second highest was during the dot com bubble in the late 90s – early 2000.

PE ratio alone is not a great predictor of future stock market returns. Remember, folks, the market is always forward-looking. Expensive markets can become more expensive. Revenue growth and earnings can often catch up with prices after stalling for a while.

2025 will be the year of patience and accumulation

“The stock market will do whatever it has to do to embarrass the greatest number of people to the greatest extent possible” – Walter Deemer

What should we expect from the stock market in 2025? Expect the unexpected. The market will try to fool you. 2025 already looks hard to predict – a new old President, the Federal Reserve at a crossroads, AI spending potentially slowing down, and global tensions.

In 2024, I expected the S&P 500 to return 8% to 12% despite many predictions of a hard landing and imminent recession. The market proved much more resilient and went full steam ahead, clocking a gain of 24%.

My base case is that the first half of 2025 will likely experience significant stock market volatility as stocks adjust to shifting economic and policy landscapes under Trump’s second term. Investors could encounter frequent swings between gains and losses as the market digests new information and recalibrate its expectations.

AI earnings will be in focus as well. Investors will eagerly wait to see if Big Tech companies can maintain higher growth rates and margins. The winners from the prior two years (NVDA, Broadcom, Meta, Amazon, Microsoft, Palantir) may take a break or continue to higher. A new player might show up to the party.

As I showcased earlier, years ending in 5 tend to have great returns. Hopefully, we keep the trend. Given that we already had two back-to-back 20% + years, it’s doubtful we will have a third one. But you never know. My base case is that we will have a modest return in the range of 5% to 10%, and most of the stock market gains will come in the second half of 2025. That’s almost a mirror version of the Stiffel and Fundstrat prediction. Let’s see what happens.

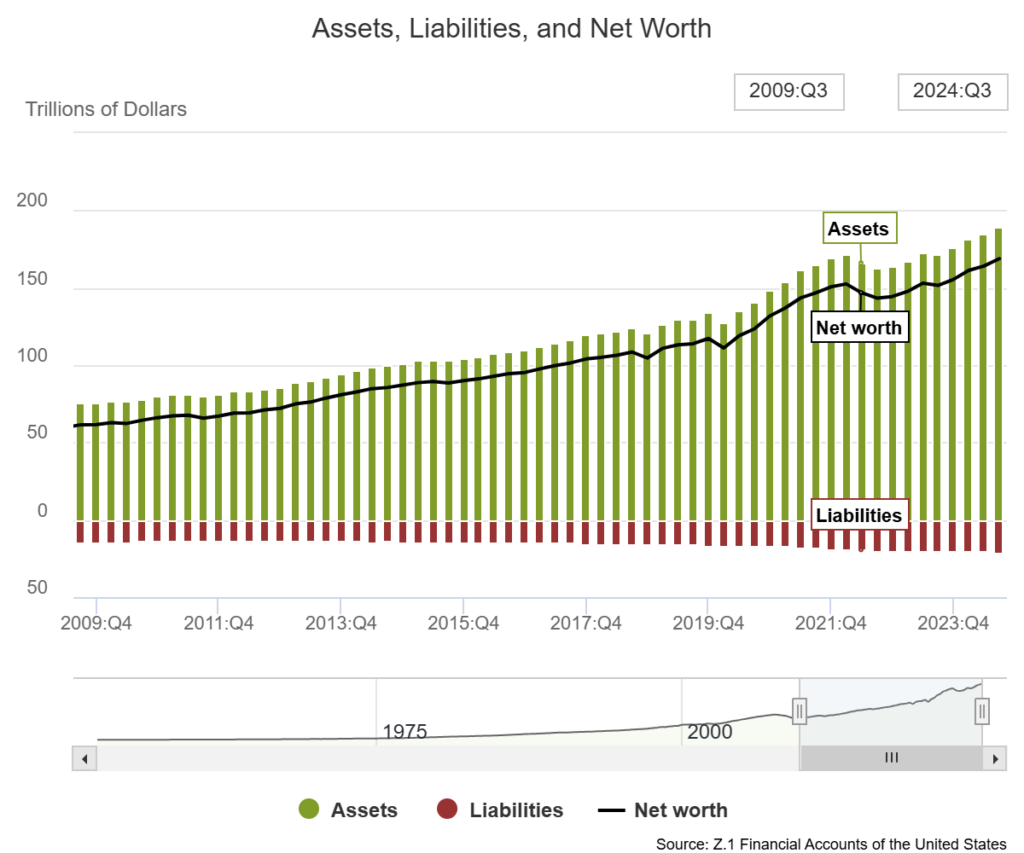

US Consumer Net Worth at an All-Time High

Despite recent economic disruptions, US consumer net worth is at record levels. Consumer wealth has increased significantly due to rising home values, resilient savings rates, higher money supply, and a strong equity market performance in the past 5 years. Not to mention that the government printed money and

High consumer net worth provides a buffer against economic shocks and supports sustained consumer spending, a critical component of GDP. This wealth effect may help mitigate the impacts of market volatility, ensuring stable demand for goods and services, which bolsters corporate revenues and profits.

Gradual Fed Interest Rate Cuts with Flexibility for More

The Federal Reserve will continue its cautious approach to reducing interest rates. Gradual cuts will foster growth without overheating the economy. Additionally, the Fed retains the flexibility to implement deeper rate cuts should economic conditions worsen, such as a downturn in labor markets or sluggish GDP growth. This accommodative monetary stance provides a backstop for the economy and could enhance risk appetite in the financial markets by reducing borrowing costs and supporting asset valuations.

Massive Liquidity on the Sidelines

An unprecedented $7 trillion in US money market funds and an additional $3 trillion outside the US are sitting on the sidelines while the Fed cuts interest rates. This idle capital represents a significant potential to fuel the economy and the stock market. As confidence in the economy grows, this money could reenter the stock market, fueling upward momentum. This vast liquidity underscores a robust demand for investment opportunities, which could act as a stabilizing force or bullish driver for the stock market in the second half of 2025.

Trump’s Pro-Market Stance

In his first term, Trump consistently pursued policies that were favorable to the market, including corporate tax cuts, deregulation, and infrastructure spending initiatives. His administration’s emphasis on economic growth and market-friendly policies will provide a supportive backdrop for equities. His inner circle and Treasury secretary nominee have close links with the stock market. Trump’s pro-market positioning should help maintain investor confidence and corporate earnings if played right.

No Viable Alternative to the US Stock Market

The US stock market remains the most attractive investment destination for global investors. Factors such as its relative financial stability, economic diversity, low regulation, focus on shareholder value, strong corporate earnings, robust capital markets infrastructure, and a history of innovation create a compelling case. Alternatives such as international developed and emerging markets stocks or bonds lack the growth upside and safety US equities offer. Therefore, investors will likely continue favoring the US market, further bolstering its resilience and long-term appeal.

AI Productivity will boost earnings.

AI-driven productivity and automation will boost corporate earnings by streamlining operations, reducing costs, and enabling faster data-driven decision-making. By automating repetitive tasks, companies can reallocate resources to high-value activities, improving efficiency and output quality. AI tools enhance workforce productivity through predictive analytics, improved customer service, and optimized supply chains, minimizing downtime and errors. Moreover, AI enables rapid innovation and personalized offerings, driving higher customer satisfaction and revenue growth. These advancements collectively create significant cost savings, operating efficiencies, and new revenue opportunities, directly enhancing corporate profitability.

Contact Us