Tag Financial Planning

The Smart Way to Manage Your Sudden Wealth

Getting rich is the dream of many people. When your sudden wealth becomes a reality, you need to be ready for the new responsibilities and challenges. As someone experienced in helping my clients manage their sudden wealth, I want to…

Roth IRA and why you probably need one – Updated for 2022

Roth IRA is a tax-exempt investment account that allows you to make after-tax contributions to save for retirement. The Roth IRA has a tax-free status. It is a great way to save for retirement and meet your financial goals without…

8 reasons to open a solo 401k plan

Updated for 2024 What is a solo 401k plan? The solo 401k plan is a powerful tool for entrepreneurs to save money for retirement and reduce their current tax bill. These plans are often ignored and overshadowed by the more…

A financial checklist for young families

A financial checklist for young families…..Many of my clients are young families looking for help to build their wealth and improve their finances. We typically discuss a broad range of topics from buying a house, saving for retirement, savings for…

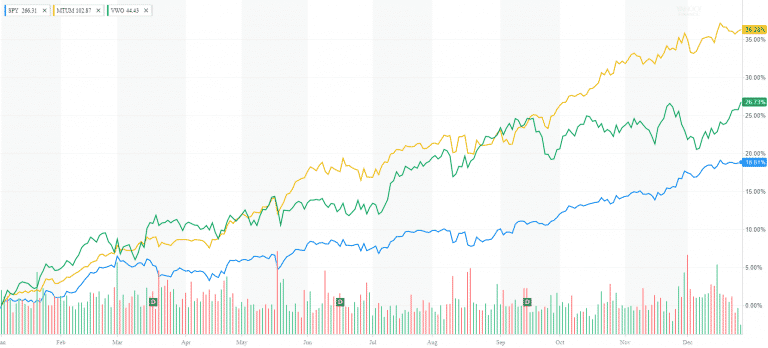

Market Outlook October 2018

Overview The US stock market was on an absolute tear this summer. S&P 500 went up by 7.65% and completed its best 3rd quarter since 2013. Despite the February correction, the US stocks managed to recover from the 10% drop. All…

9 Smart Tax Saving Strategies for High Net Worth Individuals

The Tax Cuts and Jobs Act (TCJA) voted by Congress in late 2017 introduced significant changes to the way high net worth individuals and families file and pay their taxes. The key changes included the doubling of the standard deduction to $12,000…

Market Outlook December 2017

Market Outlook December 2017 As we approach 2018, it‘s time to reconcile the past 365 days of 2017. We are sending off a very exciting and tempestuous year. The stock market is at an all-time high. Volatility is at a…

6 Saving & Investment Practices All Business Owners Should Follow

In my practice, I often meet with small business owners who have the entire life savings and family fortune tied up to their company. For many of them, their business is the only way out to retirement. With this post,…

End of Summer Market Review

End of Summer Market Review Happy Labor Day! Our hearts are with the people of Texas! I wish them to remain strong and resilient against the catastrophic damages of Hurricane Harvey. As someone who experienced Sandy, I can emphasize with…

10 ways to grow your savings during medical residency

As someone married to a physician, I happen to have many friends in the medical field. Most doctors have to go through a brutal residency program. The medical residency takes between three and five years. Residents have a hectic working…

5 Myths and One True Fact about passive investing

The passive investing in ETFs and index funds has experienced a massive influx of money in the past ten years. The US ETF market is quickly approaching $3 trillion in assets under management. As of March 29, 2017, the total…

Top 5 Strategies to Protect Your Portfolio from Inflation

Protecting Your Portfolio from Inflation The 2016 election revived the hopes of some market participants for higher interest rates and higher inflation. Indeed, the 10-year Treasury rate went from 1.45% in July to 2.5% in December before settling at around…

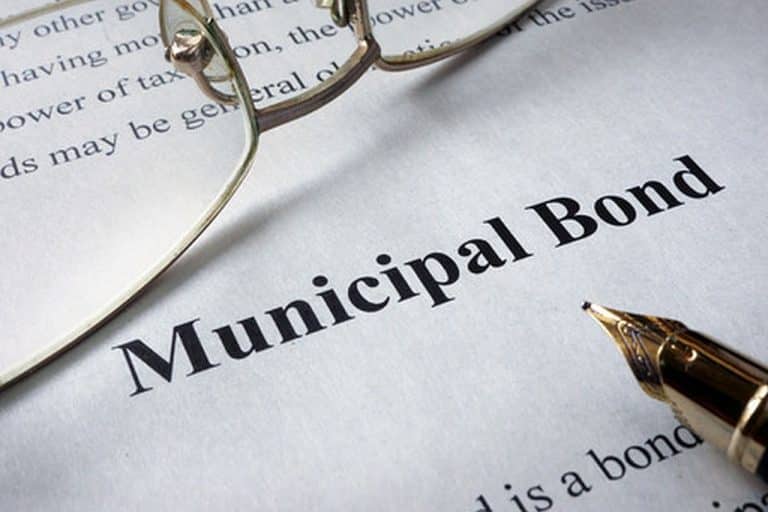

Municipal Bond Investing

What is a Municipal Bond? Municipal bond investing is a popular income choice for many Americans. The muni bonds are debt securities issued by municipal authorities like States, Counties, Cities, and related businesses. Municipal bonds or “munis” are issued to…

14 Effective ways to take control of your taxes

In this blog post, I will go over several popular and some not so obvious tax deductions and strategies that can help you decrease your annual tax burden. Let’s be honest. Nobody wants to pay taxes. However, taxes are necessary…

Incentive Stock Options

What is an Incentive Stock Option? Incentive stock options (ISOs) are a type of equity compensation used by companies to reward and retain their employees. ISOs have more favorable tax treatment than non-qualified stock options. While similar to NQSOs, they…

Non-Qualified Stock Options

What are Non-qualified stock options? Non-qualified Stock Options (NSOS) are a popular type of Employee Stock Options (ESO) and a favorite tool by employers to reward and retain workers. NSOs are a contract between the employee and the employer giving…

11 Effective financial strategies for business owners

Eleven ways to boost and protect your wealth Small and mid-size businesses are the backbone of the US economy. Entrepreneurship and creativity have been moving the American economy for centuries. In fact, the US has one of the best grooming…

Contact Us