The December market meltdown explained

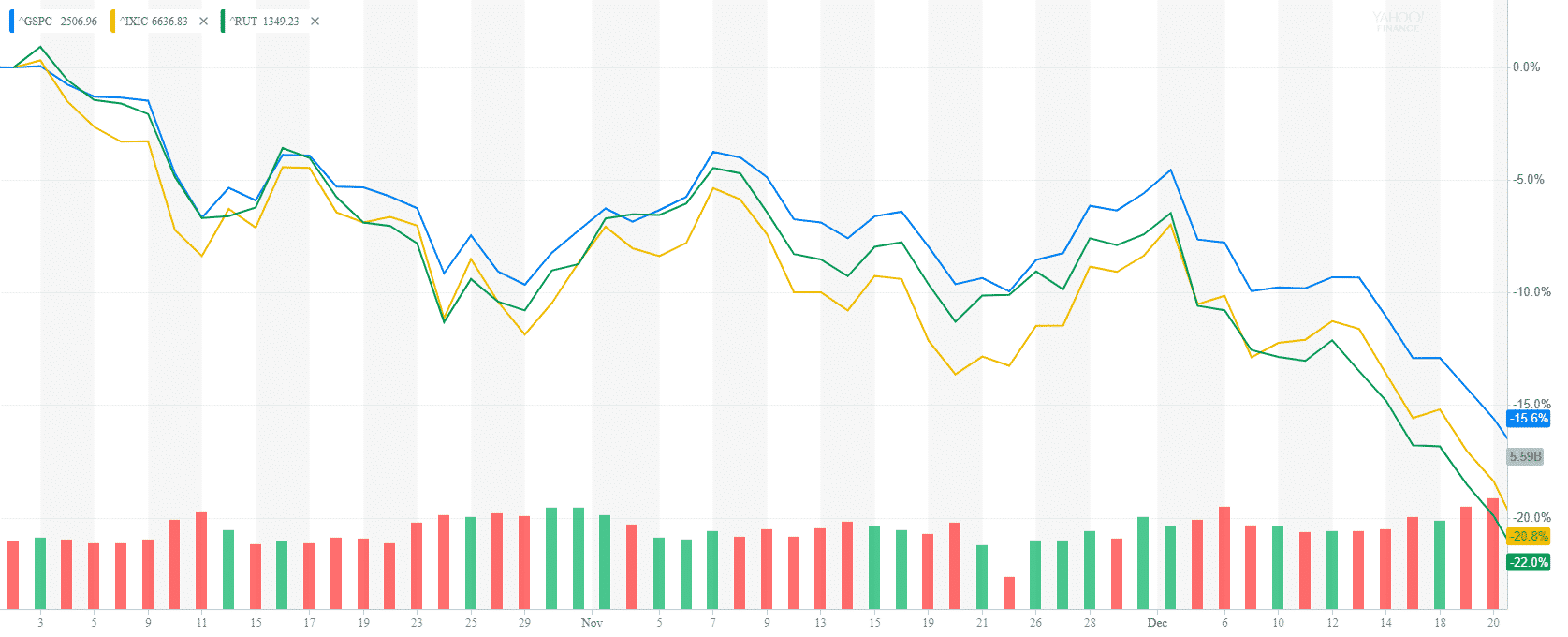

S&P 500 is down almost -16% so far in the last quarter of 2018. The market rout which started in October continued with a powerful selloff in December. The technology-heavy NASDAQ is down -20%, while the small-cap Russell 2000 dropped nearly -22%.

Despite our strong economy major buyers remain on the sideline and retail investors are looking for a bottom

In my previous article, I talked about the perfect storm that started the market drop in October. Since then more negative news continued to bombard the markets. The markets do not like uncertainty.

Here are some of the factors that triggered fears across the sellers.

- Apple stopping to report iPhone sales

- FedEx reporting lower guidance for 2019

- The resignation of General Mattis

- Government shutdown

- Failing Brexit negotiations

- Trump criticizing the Fed

- The recent arrest of Huawei CFO and three Canadians in China

- The price of oil dropping to $43.

- Yield curve inversion

Growin fears for an upcoming recession- The dominance of electronic and algorithm trading

- Low trading volumes due to the holiday season

The combination of more negative news and low trading volumes created yet another perfect storm for what we observed in December 2018.

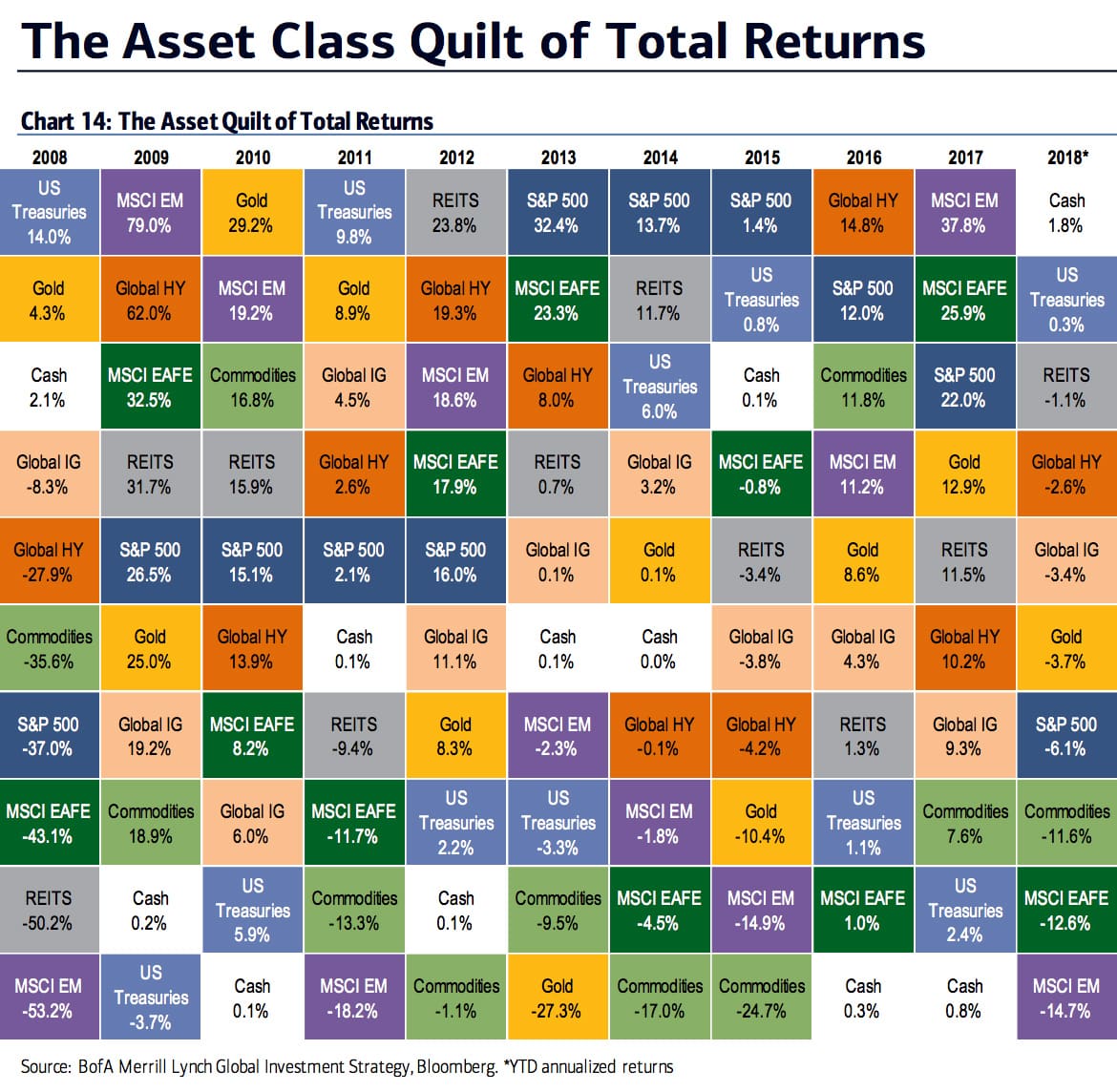

The asset classes performance

2018 will remain in history as the year when holding cash was the only profitable strategy. Almost all major asset classes are in the red for 2018.

Future Outlook

As I mentioned earlier, all major macroeconomic factors are in

- Highest corporate earnings growth since 2010

- GDP growth over 3%

- Record high consumer sentiment

- End of year holiday shopping is expected to beat all records

- Record low unemployment

- Highest wage growth since 2008

- Business activity remains high

- Interest rates stay under historical levels

- Low oil prices will temper inflation and business cost

Many economists believe that we are in the last leg of economic expansion. Moreover, some are even predicting a market recession in 2020. However, there is an old joke that the markets have predicted 9 out of the past 5 recessions. In spite the fact that equity markets are forward-looking, they have not been an accurate indicator for an economic recession.

Realistically speaking it would be very hard to enter recession from where we are today unless we see a very steep deterioration in 2019.

The law of mean reversion.

Everything reverts to the mean sooner or later. Last year we had one of the least volatile markets in our recent history. As a result, the S&P 500 standard deviation, a measure of risk, dropped to 3.8% well below average historical levels of 13%. This year’s market volatility is back to these average levels.

Diversify

In any market environment, volatile or not, diversification is essential way to reduce portfolio risk.

Think long term

The best long-term investment strategy has always been buy-and-hold. Trying to time the market is a bad idea. There are many studies that show timing the market would underperform a buy and hold strategy in the long run.

Don’t watch the market every day.

Media skews the news to what is trendy and get more readership.

Use your best judgement.

Panicking has never helped anyone. If you are uncertain seek advice from a fiduciary advisor who has your best interest in mind.

About the author:

Stoyan Panayotov, CFA is the founder and CEO of Babylon Wealth Management, a fee-only investment advisory firm based in Walnut Creek, CA. Babylon Wealth Management offers personalized wealth management and financial planning services to individuals and families. To learn more visit our Private Client Services page here. Additionally, we offer Outsourced Chief Investment Officer services to professional advisors (RIAs), family offices, endowments, defined benefit plans, and other institutional clients. To find out more visit our OCIO page here.

Disclaimer: Past performance does not guarantee future performance. Nothing in this article should be construed as a solicitation or offer, or recommendation, to buy or sell any security. The content of this article is a sole opinion of the author and Babylon Wealth Management. The opinion and information provided are only valid at the time of publishing this article. Investing in these asset classes may not be appropriate for your investment portfolio. If you decide to invest in any of the instruments discussed in the posting, you have to consider your risk tolerance, investment objectives, asset allocation, and overall financial situation. Different investors have different financial circumstances, and not all recommendations apply to everybody. Seek advice from your investment advisor before proceeding with any investment decisions. Various sources may provide different figures due to variations in methodology and timing,

Contact Us