Successful strategies for (NOT) timing the stock market

Timing the stock market is an enticing idea for many investors. However, even experienced investment professionals find it nearly impossible to predict the daily market swings, instant sector rotations, and ever-changing investors’ sentiments. The notion that you can perfectly sell at the top of the market and buy at the bottom is naïve and oftentimes leads to bad decisions.

The 24-hour news cycle is constantly bombarding us. The speed and scale of information could easily bounce the stock market between desperation, apathy, and fear to euphoria, FOMO, and irrational exuberance.

In that sense, the market volatility can be unnerving and depressing. However, for long-term investors, trying to time the market tops and bottoms is a fool’s errand. Constantly making an effort to figure out when to get in and get out can fire back. There is tremendous evidence that most investors reduce their long-term returns trying to time the market. Market timers are more likely to chase the market up and down and get whipsawed, buying high and selling low.

The hidden cost of timing the stock market

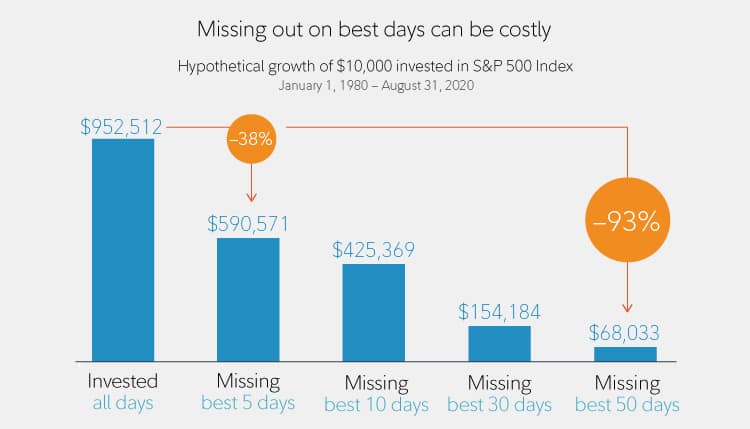

There is a hidden cost in market timing. According to Fidelity, just missing 5 of the best trading days in the past 40 years could lower your total return by 38%. Missing the best 10 days will cut your return in half.

For further discussion on how to manage your portfolio during times of extreme market volatility, check my article on “Understanding Tail Risk“

Rapid trading

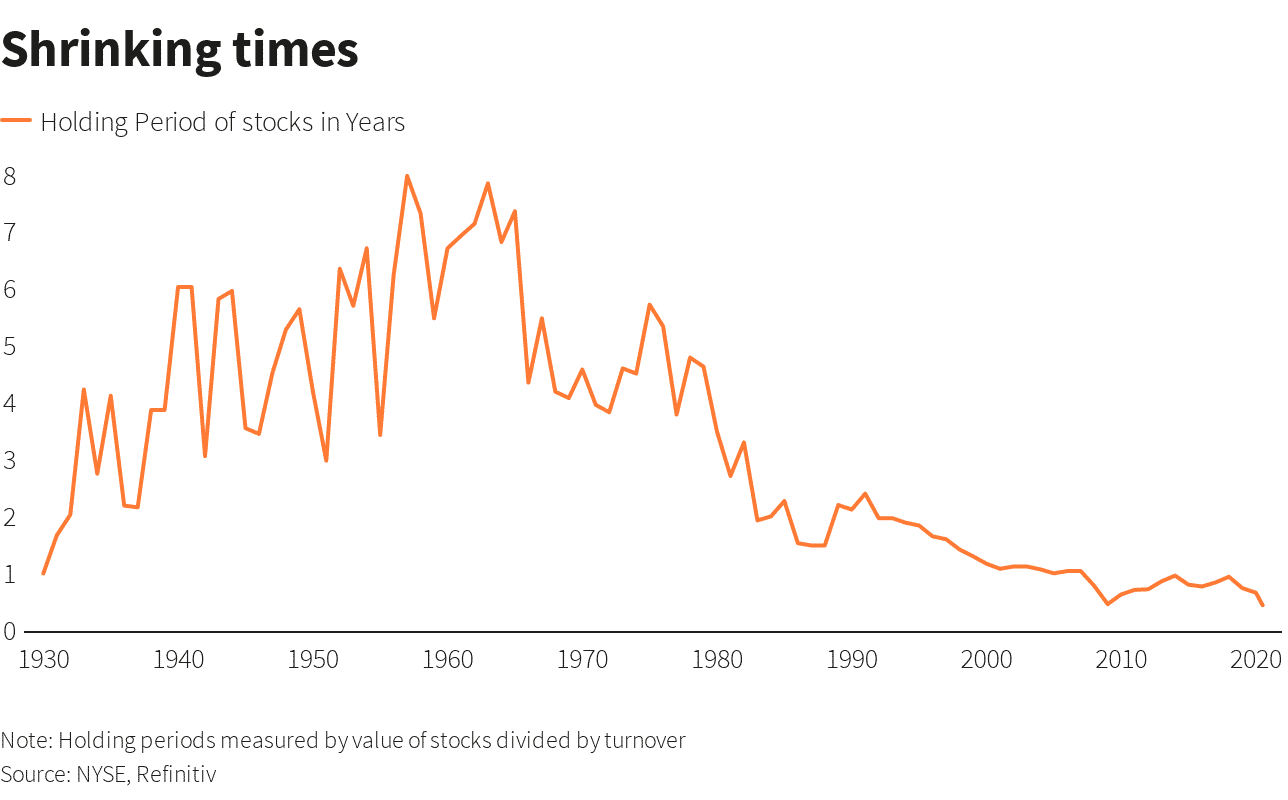

Today’s stock market is dominated by algorithm trading platforms and swing traders with extremely short investment horizons. Most computerized trading strategies hold their shares for a few seconds, not even minutes. Many of these strategies are run by large hedge funds. They trade based on market signals, momentum, and various inputs built within their models. They can process information in nanoseconds and make rapid trades. The average long-term investors cannot and should not attempt to outsmart these computer models daily.

Reuters calculated that the average holding period for U.S. shares was 5-1/2 months as of June 2020, versus 8-1/2 months at the of end-2019. In 1999, for example, the average holding period was 14 months. In the 1960s and 1970, the investors kept their shares for 6 to 8 years.

The market timing strategy gives those investors a sense of control and empowerment, It doesn’t necessarily mean that they are making the right decisions.

So, if market turmoil gives you a hard time, here are some strategies that can help you through volatile times.

Dollar-cost average

DCA is the proven approach always to be able to time the market. With DCA, you make constant periodic investments in the stock market. And you continue to make these investments whether the market is up or down. The best example of DCA is your 401k plan. Your payroll contributions automatically invest every two weeks.

Diversify

Diversification is the only free lunch in investing. Diversification allows you to invest in a broad range of asset classes with a lower correlation between them. The biggest benefit is lowering the risk of your investment portfolio, reducing volatility, and achieving better risk-adjusted returns. A well-diversified portfolio will allow your investments to grow at various stages of the economic cycle as the performance of the assets moves in different directions.

Rebalance

Rebalancing is the process of trimming your winners and reinvesting in other asset classes that haven’t performed as successfully. Naturally, one may ask, why should I sell my winners? The quick answer is diversification. You don’t want your portfolio to become too heavy in a specific stock, mutual fund, or ETF. By limiting your exposure, you will allow yourself to realize gains and buy other securities with a different risk profile.

Buy and hold

For most folks, Buy and Hold is probably the best long-term strategy. As you saw earlier, there is a huge hidden cost of missing out on the best trading days in a given period. So being patient and resilient to noise and negative news will ultimately boost your wealth. You have to be in it to win it.

Tax-loss harvesting

If you are holding stocks in your portfolio, the tax-loss harvesting allows you to take advantage of price dips and lower your taxes. This strategy works by selling your losers at a loss and using the proceeds to buy similar security with an identical risk-reward profile. At the time of this article, you can use capital losses to offset any capital gains from the sale of profitable investments. Furthermore, you can use up to $3,000 of residual capital loss to offset your regular income. The unused amount of capital loss can be carried forward in the next calendar year and beyond until it’s fully used.

Maintain a cash reserve

I advise all my clients to maintain an emergency fund sufficient to cover at least 6 months worth of expenses. An emergency fund is especially critical If you are relying on your investment portfolio for income. The money in your emergency fund will help you withstand any unexpected market turbulence and decline in your portfolio balance. A great example would be the rapid market correction in March 2020 at the onset of the coronavirus outbreak. If you needed to sell stocks from your portfolio, you would be in tough luck. But if you had enough cash to keep afloat through the crisis, you would have been in a perfect position to enjoy the next market rebound.

Focus on your long term goals

My best advice to my clients who get nervous about the stock market is to focus on what they can control. Define your long-term goals and make a plan on how to achieve them. The stock market volatility can be a setback but also a huge opportunity for you. Follow your plan no matter what happens on the stock market. Step back from the noise and focus on strengthening your financial life.

Contact Us