Why investors should cheer this bear market

There is no doubt that 2022 has been a brutal year for investors. Many marquee household companies are down 30%, 40%, and 50%. Some have posted their worst performance in their history. The conservative bond investors didn’t have much to cheer about either. The Fed raised their interest rates from practically zero to 4.15%, which led to a drop in the value of most bond investments. For once in a lifetime, both equities and bonds fell simultaneously. Inflation reached a 40-year high.

2022 in the rearview mirror

The world witnessed the first European war and threats of using nuclear weapons since World War II. And China imposed a zero covid lockdown that led Chinese citizens to be isolated in their homes for weeks and months. Adding to that the persistent covid outbreaks, RSV and monkeypox, $6 oil at the pump during the summer months, Hurricane Ian, the heatwave in California, and the polar vortex in Midwest.

And to add some entertainment to the public, the no longer richest person in the world decided to burn $44 billion on fire just because he could. Another young fellow in shorts and burly hair chose to use $3 billion in customer money to pursue his agenda and earn a comparison with Bernie Madoff. Let’s not forget that we had a mid-year election, and Democrats won the Senate, and the Republicans won the House. I am sure I am missing something.

So the regular folks like you and me could barely catch our breaths from one breaking news to the next in 2022. The journalist had a busy year. One could naturally wonder what 2023 has prepared for us.

Joe Biden, 80, and Trump, 76, declared they will run for president in 2024, as you know. I won’t comment on politics, but I expect the race to keep us glued to our smart devices and TVs through the election cycle.

Wall Street projections for 2023

Wall Street is also very divided in its projections. The S&P 500 ended the year at 3,839. The average estimate is for the index to finish at 4,031, with a huge gap between bulls and bears. The highest forecast is for 4,500, while the lowest reading is for $3,400. As a comparison, for 2022, the lowest forecast was for 4,400. So even the biggest bear got it wrong a big time.

Place your bets and throw the dice. If experts whose jobs are making market predictions can’t agree on where the market is heading, what about the average investor?

Despite all the gloom and doom that the media is trying to throw at us, there are a few things to cheer for in 2023. Let’s go through the list.

1. Earn interest on your cash savings.

After a decade of zero rates, you can finally earn a decent interest on your cash savings. You can easily earn 4% by buying a CD and over 3% in a high-yield online savings account. You have an excellent opportunity to build your emergency savings and earn a small return for keeping your money for a rainy day.

2. Better deals during a recession.

Most Wall Street economists are predicting a recession in 2023. Before you get too caught up in pessimism, I would like to cheer you up with the old Wall Street joke that economists have predicted the 9 of the past 5 recessions.

One thing I learned with great certainty in my forty-something years in this world is that it’s very hard to predict the future.

So whether the economists are right or wrong this time around remains to be seen. However, I clearly remember from the last two recessions in 2020 and 2008-2009 that some of the best deals occur during an economic slowdown. Retailers are clearing inventories at a deep discount. Contractors are willing to take smaller jobs. Family vacations get more affordable.

If you plan a home remodel or a big purchase, this might be your opportunity to lower your cost and negotiate your price.

3. Contribute more dollars to your 401k and Roth IRA.

I bet all devoted retirement savers love the news that 401k contribution limits went up by nearly 10% from $20,500 to $22,500. The catch-up contribution limit for employees over the age of 50 will increase to $7,500. The Roth IRA enthusiasts can save $6,500 in 2023, up from $6,000 in 2022.

4. You are getting a tax break.

Everything is going up these days. You have seen those price anomalies in your local restaurants and neighborhood supermarkets.

The good news is that tax brackets and standard deductions are also going up. Whether you got a promotion last year or your salary remained the same in 2023, you will catch a bit of a tax break.

For example, a married couple earning $250,000 in joint income and using the standard deduction will pay $40,152.00 in Federal Income taxes in 2023 vs. $41,455.00 in 2022.

5. Dollar-cost averaging

With the stock market down and a lot of uncertainty ahead, dollar-cost averaging is ideal for any remaining investors wanting to put new money in the market. I have previously discussed how timing the market can hurt your long-term financial goals. Dollar-cost averaging lets you have one foot in the water without jumping all in.

Dollar-cost averaging is a strategy that allows you to invest a specified amount of money periodically regardless of the market direction. Your bi-weekly 401k contributions are a perfect example of how dollar-cost averaging works. By participating in your employer 401k plan, you make consistent investments in the stock market every two weeks.

6. Lower valuations mean higher expected returns.

If I had offered a year ago to buy Amazon or Tesla shares at a 50% discount, would you have taken my offer? Some of you may have thought that I am crazy. I am sure a few people with an above-average risk tolerance would have taken it. But here we are. A long list of stocks has come down to Earth from sky-high valuations. For us, the investors, these lower prices mean only one thing – higher expected future returns.

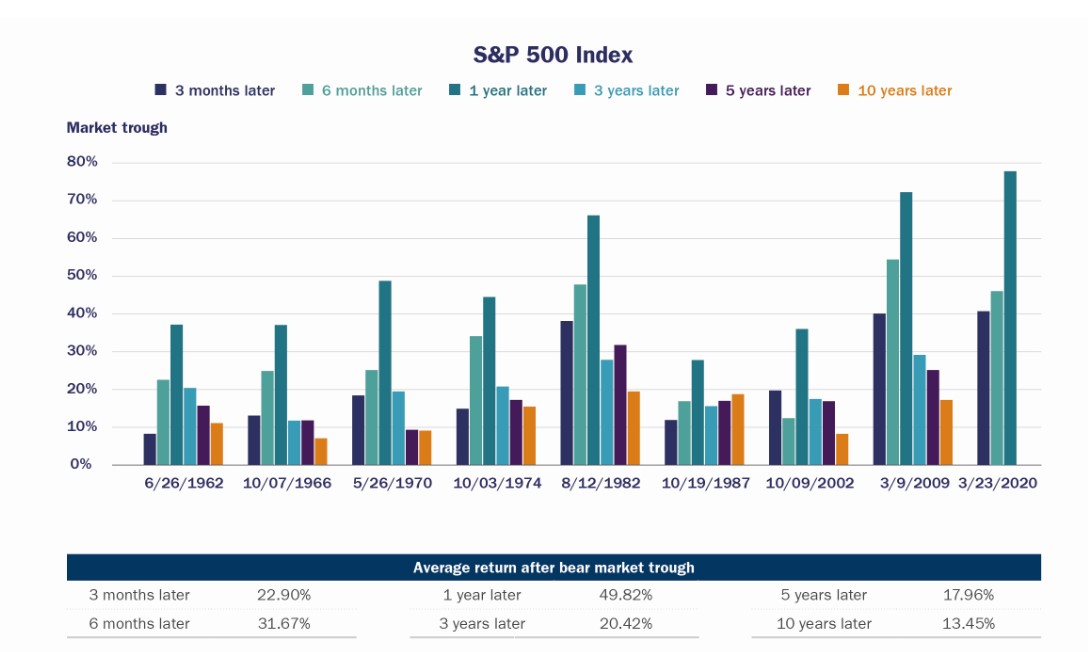

Check out the chart below. The average 1-year return after a bear market bottom is nearly 50%. The annualized 5-year return is nearly 18%, and the 10-year return is 13.45%. For compassion, S&P 500 average annualized 20-year return is 9.80%

As you can tell, as you get closer to the bottom of the bear market, the risk-reward potential becomes very attractive for both long-term investors and short-term traders. So those investors who are willing to weather the storm can reap the benefits in the future.

7. Stock picking is back.

Passive index investing underscored the last decade of investing after the end of the financial crisis. The mega-cap tech stock like Apple, Microsoft, Google, and Amazon dominated the S&P 500. The near-zero interest rate torpedoed the growth of smaller software and semiconductor firms with little to no earnings. The market wanted to pay for growth at any price until it didn’t.

We reached an inflection point that allows and forces us to evaluate each company individually based on its own merits. The new bull market wave will not take everyone with it this time. Firms that adapt quickly to new economic realities can succeed and reach their prior highs. Others will be left in the dust. New winners will be born.

8. Invest in yourself.

Your biggest asset is yourself. It’s not your house, job, car, or investment portfolio. It’s you. Invest in yourself by:

- building new relationships

- learning new skills

- getting a new job

- improving your health

- focusing on what makes you happy.

Manage your life the same way we manage your retirement portfolio by focusing on your long-term goals, diversifying your skills and connections, and remaining disciplined through lifecycles.

9. Live to fight another day.

You will agree that the last three years were not exactly a walk in the park.

- 2020 was the year of covid and the great lockdown.

- 2021 was the year of the great reopening and the supply chain disruption.

- 2022 was the year of the great reset of expectations.

What will 2023 be? I will tell you for sure in 12 months, but I won’t mind if it’s a bit boring and uneventful.

So whether you are a bull or a bear, an optimist or a pessimist, an extrovert or an introvert, a wine aficionado or a foodie, be nice to yourself. Give yourself a big tap on the shoulder. You made it. Whatever 2023 ends ups being, make it the GREAT YEAR OF BEING YOU.

Contact Us